In the world of digital assets, the term “stablecoin investment” is appearing more and more often in online searches and professional discussions.

Yet, its meaning can be ambiguous: some use it to describe a simple way of preserving value in digital currencies pegged to fiat money; others refer to decentralized finance (DeFi) mechanisms that generate yields; and some see it as a treasury management tool for companies seeking stability and liquidity.

This article provides a clear, educational overview to clarify the fundamentals:

what a stablecoin is, the different types that exist, what the concept of “investment” really means in this context, the main risks involved, and the regulatory framework to be aware of.

It is a purely informational resource, not financial or investment advice.

Our goal is to give readers a clear and balanced understanding of this rapidly evolving topic — covering the technical, economic, and regulatory dimensions that shape how stablecoins are used today.

Summary of the article

- Stablecoin: a cryptocurrency (or digital asset) designed to maintain a nearly fixed value relative to a reference asset such as the euro, the dollar, or gold.

- Three main use cases: store of value, fast settlement method, or yield generation through third-party services.

- Yield ≠ stablecoin: any potential return comes from external platforms (lending, liquidity pools), not from the token itself.

- Key risks: counterparty or reserve risk, depeg events, technical failures, liquidity shortages, and regulatory uncertainty.

- MiCA (EU): mandatory authorization, segregated custody of reserves, regular reporting, and redemption rights for EMTs; stricter governance and capital requirements for ARTs.

- Taxation: depends on the country of residence; in France, taxation generally applies when converting crypto assets into fiat currency.

- Regular: a European platform registered as a Digital Asset Service Provider (PSAN) with the AMF, offering a regulated environment for managing digital assets — without providing investment advice.

Informational summary only — not financial advice or personalized recommendations.

Stablecoins: definition and main types

A stablecoin is a digital currency (or crypto asset) designed to maintain a nearly fixed value relative to a reference asset such as a fiat currency or a commodity.

For example, 1 EURC = 1 euro and 1 USDC = 1 US dollar.

Stablecoins combine the efficiency of blockchain technology — fast transactions, low fees, and transparent traceability — with price stability, unlike traditional cryptocurrencies whose value can fluctuate dramatically.

The idea is to offer a digital token that can serve as both a medium of exchange and a store of value.

In practice?

You could, for instance, pay an invoice of €50,000 to a business in just 30 seconds, for a few cents in fees, regardless of where the company is located — simply by transferring 50,000 EURC.

There are several mechanisms designed to maintain this price stability:

Asset-backed stablecoins

These are the most common type. The assets held as collateral may include Treasury bills, precious metals, cryptocurrencies, or fiat currencies. Diversifying collateral reduces reliance on a single asset class but increases governance complexity and requires strict rules for valuation and custody to prevent a loss of peg.

For example, to back 1 USDC in circulation, Circle holds approximately $0.95 in U.S. Treasury bills and $0.05 in cash deposits.

Under the European MiCA framework, a distinction is made between Electronic Money Tokens (EMTs) — backed primarily by cash and intended for payment use — and Asset-Referenced Tokens (ARTs), which are pegged to a basket of assets.

Stablecoins backed by hedging strategies (“delta-neutral”)

Some projects (e.g., Ethena) maintain price stability not through reserves, but via hedging strategies. For each long position (e.g., holding ETH), they open an equivalent short position using futures contracts.

This mechanism reduces volatility but relies on the proper functioning of derivatives markets and carries liquidity and funding risks.

It is not an official MiCA category, but rather an experimental approach to achieving stability.

Algorithmic stablecoins

These stablecoins have no tangible reserves. Instead, algorithms automatically adjust supply and demand to maintain the target price.

While innovative, this model has proven fragile during market crises — as seen with the collapse of UST in 2022 — and carries a heightened risk of losing its peg.

Summary table – Types of stablecoins

| Type of stablecoin | Peg mechanism | Regulatory / legal framework | Expected transparency | Key risks |

|---|---|---|---|---|

| EMT – Electronic Money Token (stablecoin backed by a single fiat currency) | 100% reserves in the reference currency (USD, EUR, etc.), held in bank accounts or short-term Treasury bills. | Licensed Electronic Money Institution (EMI) or equivalent under MiCA. | Monthly attestations, external audits, right of redemption at face value at any time. | Counterparty and banking risk, regulatory freezes, geographic access restrictions. |

| ART – Asset-Referenced Token (backed by a basket of assets) | Diversified collateral: multiple currencies, metals, crypto assets, or bonds. | Specific ART license under MiCA, with reinforced governance and capital requirements. | Detailed reporting on the composition and valuation of the collateral basket. | Risk of depeg if one asset drops sharply, complex governance, less transparency of reserves. |

| Commodity-backed stablecoin (backed by a physical asset) | Each token represents a physical quantity of a commodity (e.g., gold, silver, oil). | Often outside MiCA; may fall under commodity or derivatives regulations, depending on jurisdiction. | Proof of storage, insurance certificates, independent custody audits. | Low liquidity, high custody costs, dependency on physical market conditions and storage location. |

| Decentralized stablecoin (DeFi / crypto-collateralized) | Collateralized by other crypto assets (e.g., DAI, LUSD) through overcollateralized smart contracts. | No direct MiCA status; operates as a decentralized protocol. | Full on-chain transparency of reserves, governance by token holders. | Collateral liquidation risk, smart contract bugs, temporary depeg during crypto market crashes. |

| Pure algorithmic stablecoin | Automatically adjusts supply and demand without real collateral. | Generally non-compliant with MiCA, highly speculative model. | Open-source code, community-based governance. | Extreme risk of depeg, heavy reliance on market confidence and incentive mechanisms (e.g., Terra/UST 2022 case). |

This table is provided for informational purposes only and does not constitute investment advice in any form.

Why the term “stablecoin investment” is ambiguous

In everyday language, the idea of “investing in stablecoins” can actually refer to several very different practices.

1. Holding stablecoins as a store of value

This means keeping part of one’s assets in stablecoins to maintain exposure to a fiat currency (euro, dollar, etc.). It’s essentially a temporary way to preserve value within the crypto ecosystem — avoiding traditional banking risks but without seeking performance.

2. Using stablecoins as a settlement asset

Here, stablecoins serve primarily as a payment or transfer medium, for example to move funds between platforms or settle cross-border transactions. The price stability during the transfer and speed of settlement are the main advantages.

3. Seeking yield through third-party services

This refers to depositing stablecoins with centralized or decentralized platforms (CeFi or DeFi) that lend or use them in liquidity pools. In this case, any potential return comes from the platform’s business model, not from the stablecoin itself.

These three approaches also differ in their intended purpose:

- Non-speculative uses: fast payments, international transfers, accounting in a stable unit of value, or even temporary tax deferral depending on the jurisdiction (to be confirmed with a qualified professional).

- Yield-oriented uses: lending/borrowing, liquidity provision, yield farming, and similar activities — all of which carry specific risks (technical, liquidity, peg, and regulatory).

Clarifying these distinctions helps avoid confusing the stability of the asset itself with the remuneration conditions offered by intermediaries.

As summarized by Patrick Collison, CEO of Stripe:

“Stablecoins are superconductors for financial services. Thanks to stablecoins, businesses around the world will see significant improvements in speed, reach, and cost efficiency in the coming years.”

This perspective highlights the breadth of use cases that extend well beyond the narrow notion of “investment.”This perspective highlights the breadth of use cases that extend well beyond the narrow notion of “investment.”

Key terms to clarify

- Staking: the locking of assets to participate in network validation (Proof of Stake) and earn rewards. The term is sometimes misused to describe any interest-bearing deposit, which is incorrect.

- DeFi (Decentralized Finance): a set of financial services built on blockchain technology that operate without centralized intermediaries, relying instead on open, automated smart contracts.

- Lending / Borrowing: the act of lending or borrowing assets through a platform (centralized or DeFi). Interest paid to lenders depends on borrower demand and protocol parameters.

- Yield: the potential return generated by a third-party service (lending, liquidity pools, incentive programs). It is not inherent to the stablecoin itself.

- LP Token (Liquidity Provider Token): a token received in exchange for providing liquidity to a pool. It represents your share of the pool and allows you to withdraw your initial deposit plus accrued fees.

- Depeg: a temporary or permanent loss of a stablecoin’s peg to its target value (e.g., $1), typically caused by market stress, technical incidents, or counterparty issues.

Key risks to be aware of

Stablecoins are designed to maintain a stable value, but their operation relies on financial and technical mechanisms that introduce certain vulnerabilities.

The points below are provided for informational purposes only — they are not intended as investment advice or as guidance for risk mitigation.

Counterparty and reserve risk

For fiat-backed stablecoins (such as USDC or EURC), price stability depends directly on the quality and management of the reserves.

If the issuer mismanages these funds or fails to provide reliable audits, market confidence can erode — potentially threatening the token’s peg and overall stability.

Depeg risk (loss of peg)

A stablecoin can temporarily deviate from its target value (for example, $1) due to heavy selling pressure or doubts about its reserves.

In theory, arbitrage mechanisms are designed to restore the peg, but this rebalancing process can take time or even fail during periods of market stress or liquidity crises.

Technical risk

In the DeFi ecosystem, stablecoins rely on smart contracts and, in many cases, decentralized governance.

A code bug, security vulnerability, or malicious attack can block withdrawals or disrupt the protocols that ensure the token’s stability.

It’s therefore essential to carefully assess the reliability and audit history of each protocol before depositing funds.

Liquidity risk

Even with strong reserves, the ability to redeem or move large amounts quickly depends on market depth and the Total Value Locked (TVL) within protocols.

A bank run, sharp volatility, or sudden liquidity shortage can slow down or completely freeze withdrawals, especially on smaller or less capitalized platforms.

Regulatory / availability risk

Legal and compliance frameworks are evolving rapidly (e.g., the European MiCA regulation).

A non-compliant stablecoin may face usage restrictions or even bans in certain jurisdictions, which can limit its accessibility, reduce liquidity, and impact its acceptance across platforms.

Summary table – Main risks associated with stablecoins

| Risk | How it occurs | Warning signs | Mitigation measures (informative only) |

|---|---|---|---|

| Counterparty / reserves | Insufficient or poorly managed reserves by the issuer | Infrequent or incomplete audit reports, solvency rumors | Review published attestations and follow official statements |

| Depeg (loss of peg) | Crisis of confidence, supply/demand imbalance | Persistent price deviation from the reference currency | Check prices across multiple platforms and monitor peg history |

| Technical | Smart contract vulnerabilities, software bugs, or hacks | Security alerts, reported protocol incidents | Review code audits and follow developer announcements |

| Liquidity | Massive withdrawals or shallow market depth | Large spreads, unusually long withdrawal delays | Monitor TVL (Total Value Locked), trading volumes, and platform updates |

| Regulatory / availability | Legislative changes or incomplete compliance | Regional restriction announcements, token delisting from European exchanges | Stay informed on regulatory updates and official communications |

This table is provided for educational purposes only and does not constitute investment advice.

Market trends and outlook toward 2030

Stablecoins have already become a major force in the global financial ecosystem.

Market capitalization: around $290 billion as of today.

Usage: stablecoins now process between $70 and $90 billion in on-chain transactions per day (source: Artemis, 2025). This represents a volume comparable to—or even higher than—Visa and Mastercard’s combined daily flows, when including inter-platform transfers.

Forecasts: according to Citigroup’s baseline scenario, total capitalization could increase fivefold by 2030, while the U.S. Federal Reserve envisions a more ambitious projection — up to a 15x growth over the same period.

These figures highlight the explosive rise of stablecoins and explain the increasing regulatory scrutiny they attract.

For a detailed breakdown of Citigroup’s analysis, see the full article: Citigroup reveals its latest forecasts.

European framework: what MiCA changes for stablecoins

Gradually entering into force between 2024 and 2025, the MiCA regulation (Markets in Crypto-Assets) establishes a harmonized legal framework for crypto-assets across the European Union, with a particular focus on stablecoins.

MiCA distinguishes between two main categories:

- EMT (Electronic Money Tokens): stablecoins backed by a single fiat currency (euro, dollar, etc.), designed to faithfully mirror the value of that currency.

- ART (Asset-Referenced Tokens): stablecoins backed by a basket of assets (multiple currencies, commodities, or other crypto-assets) aiming to maintain price stability through collateral diversification.

In addition, MiCA introduces a ban on directly granting interest to holders of EMT and ART stablecoins.

Key requirements under MiCA

Regardless of category, issuers must now obtain authorization from a national authority (e.g., the AMF in France), maintain adequate capital reserves, ensure segregated custody of client funds (strict separation between company assets and token reserves), and publish regular reports on reserve composition and associated risks.

EMTs are treated as electronic money, meaning holders must be able to redeem their tokens at face value at any time.

ARTs, being more complex, face stricter obligations in terms of governance, capital adequacy, and disclosure, due to the potential volatility of their underlying assets.

MiCA does not explicitly prohibit staking for all crypto-assets. However, for regulated stablecoins (ARTs or EMTs), the regulation prohibits paying interest to holders, which may disqualify certain direct staking mechanisms — making it necessary to consider alternative yield opportunities within decentralized finance (DeFi) instead.

Practical implications within the EU

For European users, MiCA aims to strengthen trust by enforcing greater transparency on reserves, enhanced protection in case of issuer insolvency, and a guaranteed right of redemption.

However, the regulation may also restrict access to certain non-compliant stablecoins — for example, tokens pegged to the U.S. dollar or gold — which could be delisted from European platforms.

Issuers are also required to comply with anti–money laundering (AML) and counter–terrorist financing (CFT) obligations, as well as standardized regulatory disclosures on associated risks and fees.

Summary table – Key MiCA requirements

| Requirement | EMT (Single-currency token) | ART (Basket-backed token) |

|---|---|---|

| Authorization | Electronic Money Institution (EMI) license | Specific ART issuer authorization |

| Reserves | 100% held in the reference currency | Diversified basket of assets subject to strict valuation rules |

| Redemption | Right to redeem at face value at any time | Redemption mandatory but with stricter and more specific conditions |

| Reporting | Regular publications (e.g., monthly attestations) | Enhanced and detailed reporting on composition and valuation |

| Distribution | Freely distributed if denominated in euros or an EU currency | Restrictions apply if not denominated in euros or an EU currency |

| AML/CFT | Mandatory compliance | Mandatory compliance |

Regulatory glossary

- PSAN (Prestataire de Services sur Actifs Numériques) – In France, this is the Digital Asset Service Provider status issued by the AMF for crypto platforms.

- EME / EMI (Établissement de Monnaie Électronique / Electronic Money Institution) – License required to issue EMTs (Electronic Money Tokens).

- Redemption at face value – The right for any holder to redeem tokens 1:1 for fiat currency at any time.

- AML / CFT (Anti–Money Laundering / Countering the Financing of Terrorism) – Regulatory frameworks designed to prevent money laundering and terrorism financing.

- Genius Act* (United States, July 2025) – A federal law governing the issuance and supervision of stablecoins, covering roughly 95% of all circulating stablecoins.

It requires issuer registration with federal authorities, fully verified reserves, and regular audits, effectively aligning the U.S. framework with Europe’s MiCA approach.

*This reference to the Genius Act is provided for informational purposes only and does not constitute legal advice.

How “yield” emerges around stablecoins

By design, a stablecoin does not generate income on its own — its value is meant to remain stable, and it pays no dividends or automatic interest.

The “yield” often mentioned in the crypto ecosystem actually comes from third-party services that use these tokens as the foundation for financial operations.

Common mechanisms

• Liquidity pools: By supplying stablecoins to decentralized exchange (DEX) protocols — which act as on-chain currency exchange desks — users receive a share of the transaction fees generated by the pool, sometimes supplemented with governance tokens.

• Lending & borrowing: Platforms connect borrowers (often traders seeking liquidity) with lenders who deposit their stablecoins. The interest paid by borrowers is redistributed to lenders.

• Protocol incentives: Some protocols distribute reward tokens or offer temporary bonuses to attract deposits and liquidity.

• Centralized services (CeFi): Licensed companies may deploy client deposits into DeFi markets or short-term financial instruments, sharing the revenues earned with users.

Rate variability

Stablecoin yields are not fixed — they depend on available liquidity, trading volumes, borrowing demand, temporary incentives introduced by platforms, and the broader market context (bull or bear cycles, volatility, regulatory changes).

As a result, rates can fluctuate significantly over time, even for the same stablecoin.

CEX / CeFi vs DeFi

• CeFi (Centralized Finance): Intermediaries — centralized platforms, sometimes regulated — manage the funds and redistribute profits. The experience is user-friendly, but trust relies on the solvency and security of the operator.

• DeFi (Decentralized Finance): Users interact directly with non-custodial smart contracts, maintaining full control over their private keys. Rates tend to be more volatile, and the technical responsibility for managing and monitoring the position lies with the user.

Diagram – Simplified flow

Key takeaway

Yield is not an intrinsic feature of a stablecoin.

It comes exclusively from third-party services — centralized or decentralized — that use deposited assets to generate income.

These potential returns depend on market conditions, the chosen mechanisms (lending, liquidity pools, incentives), and the specific risks of each service.

This statement is provided for informational purposes only.

Tax aspects: general principles

The taxation of stablecoins depends entirely on the laws of the country of residence and on the taxable event — the moment when the authorities consider that a capital gain must be declared.

Each jurisdiction applies its own rules: some tax exchanges between crypto-assets, while others only apply taxation when crypto is converted into fiat currency (euro, dollar, etc.). Reporting obligations and capital gains calculations therefore vary widely.

In France, current practice (subject to legal updates) generally distinguishes between:

- Crypto → crypto conversion:

Exchanging one digital asset for another (e.g., Bitcoin to USDC) is not currently considered a taxable event, as long as the investor remains within the crypto ecosystem. - Crypto → fiat conversion:

Selling a crypto-asset in exchange for legal tender (euro, dollar, etc.) triggers taxation on the capital gain, typically under the flat tax (PFU) of 30% (12.8% income tax + 17.2% social contributions).

This framework remains subject to change, particularly with the implementation of the MiCA regulation in Europe and possible adjustments to French tax law.

It is therefore essential to consult a qualified professional (tax lawyer or certified accountant) for any personal situation or investment project.

Disclaimer

The information above is provided for general educational purposes only.

It does not constitute tax or legal advice.

Before making any investment or filing decision, seek guidance from a qualified tax advisor or certified accountant.

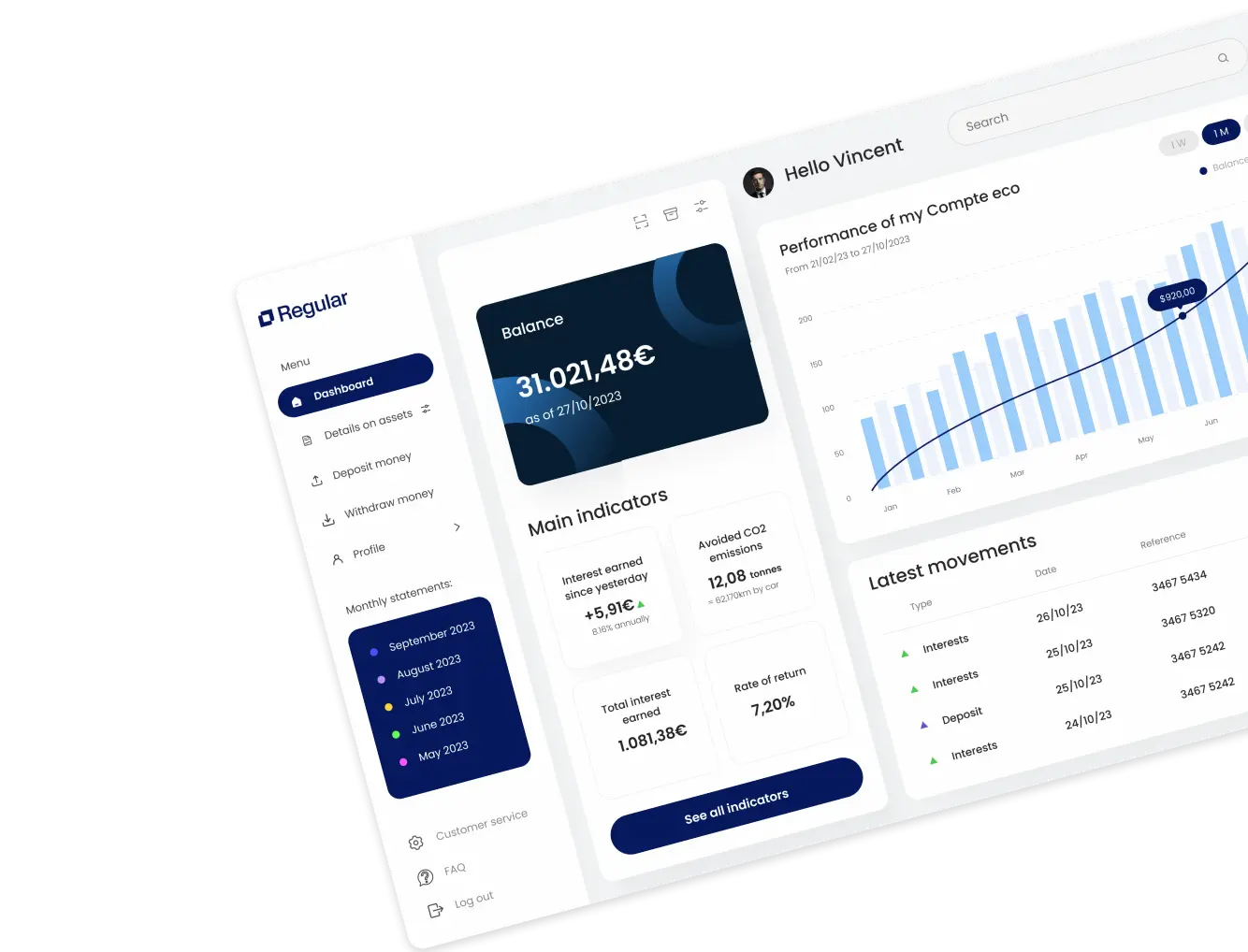

Where Regular fits in this ecosystem

Regular is a European digital asset management platform designed to make access to stablecoin-based yield strategies simpler and fully compliant with regulatory standards.

Its mission: to enable businesses and professional investors to invest in digital assets — directly from a euro bank transfer — and generate daily yield, without having to manage wallets, private keys, or asset allocations themselves.

The company is registered as a Digital Asset Service Provider (PSAN) with France’s Autorité des Marchés Financiers (AMF). This status governs activities such as digital asset custody and crypto–fiat brokerage on behalf of clients.

Regular operates a secure infrastructure for managing deposits in euros and stablecoins, with segregated custody, KYC/AML compliance (Know Your Customer and Anti–Money Laundering), and transparent disclosure of risks and returns.

The user journey is fully euro-denominated: account opening, deposit, yield generation, and withdrawals. When yield is distributed, it is based on publicly documented mechanisms — for example, exposure to DeFi protocols or digital treasury products — and always within a clear regulatory framework. All relevant information is made available on the official website.

Regular therefore positions itself as a regulated gateway for companies and qualified investors to access digital asset yields in a secure and compliant environment, without providing investment advice or guaranteeing performance.

Transparency & compliance

- Registered as a PSAN with the AMF (France) — official listing available on the public register.

- Strict KYC / AML procedures (Know Your Customer, Anti–Money Laundering, Counter–Terrorist Financing).

- Segregated custody between client funds and company capital.

- Transparent communication on risks and terms of use, detailed in the platform’s legal disclosures.

Key takeaways

- Definition: A stablecoin is a digital asset designed to maintain a stable value, typically pegged to a fiat currency (euro, dollar) or a commodity.

- Typology: Three main models — asset-backed, delta-neutral strategy–backed, and algorithmic stablecoins.

- Main risks: Counterparty and reserve quality, potential depeg (loss of peg to the reference asset), technical vulnerabilities, limited liquidity, and evolving regulations.

- MiCA framework: In Europe, MiCA introduces mandatory licensing, segregated custody, periodic reporting, and redemption rights to strengthen transparency and user protection.

- Yield ≠ stablecoin: Any potential return comes exclusively from third-party services (lending, liquidity pools, etc.), not from the stablecoin itself.

- Regular: a European-regulated platform, registered as a Digital Asset Service Provider (PSAN) with the AMF (France), providing a compliant interface for managing digital assets — without offering investment advice.

Disclaimer

The information presented in this article is provided for educational purposes only.

It does not constitute investment advice or a personalized recommendation.

Readers are encouraged to consult a qualified professional (financial advisor, tax expert) before making any investment decision or filing related to digital assets.

Stablecoins: Frequently Asked Questions

Which stablecoin is the “safest”?

There is no universally “safest” stablecoin. Evaluation depends on objective criteria: reserves (quality, liquidity, segregation), transparency (regular attestations/audits), regulatory compliance (MiCA, licensing), market liquidity (volume, multi-chain presence), and track record (incidents, depeg management). Always review public reports published by the issuer and relevant authorities.

What’s the “best way to invest” in a stablecoin?

This article does not provide investment advice. Access to stablecoins involves intermediaries: regulated centralized platforms (CEX/CeFi) or non-custodial DeFi protocols. Each option entails specific conditions (KYC, fees, custody), risks (counterparty, technical, liquidity), and rights (redemption, support). Always assess fees, reserves, and compliance before engaging in any transaction.

How can you “earn money” with stablecoins?

Yield is not inherent to a stablecoin. Third-party services (lending platforms, liquidity pools, incentive programs) may pay variable interest or rewards depending on borrowing demand, market liquidity, and protocol incentives. These potential returns come with specific risks (depeg, smart contract vulnerabilities, counterparty issues). Always review how the protocol works and check audit reports.

Are stablecoins taxable?

Taxation depends on your country of residence and the taxable event. In France, as of today, crypto→fiat conversions trigger capital gains taxation, while crypto→crypto conversions follow a separate regime. As the framework evolves (MiCA, local regulations), consult a qualified professional (lawyer or tax advisor) for your specific situation.

CBDC (digital euro) vs. private stablecoins: what’s the difference?

A CBDC (Central Bank Digital Currency) is a public currency issued by a central bank (e.g., the ECB), with legal tender status and monetary policy objectives. Private stablecoins, by contrast, are tokens issued by private entities (EMT/ART), backed by reserves and subject to MiCA regulation, but without legal tender status.