In 2025, managing a company’s cash reserves is no longer just a concern for large corporations. SMEs, startups, holding companies and even independent professionals now have access to a wide range of options to make their excess cash work — safely and efficiently.

Between higher interest rates, the comeback of attractive short-term corporate investments products, and the rise of digital solutions such as stablecoin-based investments, the corporate investment landscape has evolved dramatically.

This guide explores the best ways for companies to invest their treasury in 2025 — comparing returns, risks and liquidity — to help business owners and CFOs build a balanced, high-performing cash management strategy suited to every investment horizon.

💡 Good to know

In France, corporate cash investments are not subject to the same rules as personal savings.

A company can freely diversify its placements, provided it complies with accounting standards and selects vehicles aligned with its time horizon and risk profile.

Article summary

In 2025, businesses have a broader range of opportunities than ever to grow their idle cash.

Traditional placements — such as term deposits, capitalization contracts or real-estate funds (SCPI) — remain reliable pillars, while regulated stablecoins, now supervised under MiCA, provide a liquid and high-performance alternative.

The key lies in diversification: balancing yield and security, and relying only on regulated intermediaries for any digital investment solution.

1. Defining your company’s investment objectives

1.1 Why invest your company’s cash reserves?

Excess cash sitting in a current account inevitably loses value due to inflation. Investing that cash helps preserve the company’s purchasing power while generating a useful return.

It’s also a way to prepare for future needs — whether hiring, purchasing equipment, financing external growth, or optimizing the financial structure of a holding or real estate company.

In short, making your treasury work means turning idle resources into a genuine performance lever.

1.2 The three key decision factors

Before allocating funds, it’s essential to strike a balance between return, security, and liquidity.

- Return represents the expected performance of an investment, typically correlated with the level of risk accepted.

- Security refers to capital preservation — a top priority for short-term placements, especially when quick access to funds is required.

- Liquidity determines how easily invested funds can be accessed, a crucial factor for meeting unexpected operational needs.

1.3 Aligning your strategy with your investment horizon

The investment horizon plays a central role in any corporate treasury strategy.

- Short term: The goal is to preserve capital while earning minimal interest. Term deposits, interest-bearing accounts, or regulated stablecoin solutions fit this profile well.

- Medium term (2–5 years): The focus shifts to controlled performance through capitalization contracts, bonds, or certain real estate funds (SCPI).

- Long term (5+ years): The priority becomes capital growth through more dynamic instruments such as securities accounts, structured products, or corporate real estate investments.

| Investment horizon | Primary objective | Suitable options |

| Short term (< 2 years) | Security and availability | Term deposits, interest-bearing accounts, regulated stablecoins |

| Medium term (2–5 years) | Balanced performance | Capitalization contracts, bonds, SCPI |

| Long term (> 5 years) | Capital appreciation | Securities accounts, structured products, real estate |

📖 Key concepts to know

- Return: the expected annual performance of an investment (expressed in %/year).

- Liquidity: the ability to recover invested funds quickly without penalties.

- Risk: the probability of a partial or total capital loss, or a temporary lock-up of funds.

2. Traditional investment options for businesses

2.1 Term deposits (CAT)

Term deposits remain one of the simplest and safest ways to invest short-term corporate cash.

They are fixed-term products: the company deposits capital for a predefined period — typically from a few months to several years.

In 2025, interest rates generally range between 3% and 4.5%, depending on the duration of the lock-up.

The principal is guaranteed, and taxation is straightforward, with interest subject to corporate income tax (CIT).

Term deposits therefore stand out as a prudent cash management tool, ideal for short-term excess liquidity that needs to generate a secure, predictable return.

2.2 Capitalization contracts

A capitalization contract is an investment vehicle accessible to legal entities such as holding companies, real estate firms (SCI), associations, or commercial companies depending on their structure.

It offers strong flexibility, allowing investments in various asset types — euro funds, unit-linked supports, or real estate vehicles (SCPI, OPCI).

Average returns range from 3% to 6%, depending on the chosen risk profile.

Its favorable corporate tax treatment and flexible redemption options (partial or total) make it a long-term solution appreciated by business owners seeking diversification.

⚠️ Capitalization contract vs life insurance

Unlike a life insurance policy, a capitalization contract does not end upon the subscriber’s death.

It can be transferred or retained within a holding or real estate company, making it a valuable tool for business and wealth management continuity.

2.3 Real estate investments: SCPI and OPCI

“Paper real estate” remains a solid choice for businesses seeking medium- to long-term opportunities.

SCPI (Société Civile de Placement Immobilier) and OPCI (Organisme de Placement Collectif en Immobilier) allow companies to invest in property portfolios without direct management constraints.

With average yields between 4% and 6%, these products rely on risk mutualization and delegated management by specialized firms.

They can be subscribed directly or integrated into a capitalization contract, depending on liquidity needs and tax strategy.

2.4 Securities accounts and structured products

For holding companies and wealth-management structures with a long-term outlook, securities accounts (CTO) provide access to financial markets — stocks, bonds, ETFs, and hybrid instruments.

This type of support allows companies to energize their excess cash by investing in market-traded assets, with expected returns of 6–8% per year over the long run.

Structured products, meanwhile, combine potential performance with partial capital protection.

They are suited for companies comfortable with some market volatility and aiming for progressive, diversified performance.

These instruments, however, require a sound understanding of market mechanisms and a long-term management approach.

3. New levers for corporate returns

3.1 The rise of digital investments

The rapid evolution of financial and technological frameworks has opened up new investment opportunities for companies.

Tokenized assets, digital bonds, and stablecoins now make it possible to access more dynamic — and often more transparent — investments while maintaining high withdrawal flexibility.

These instruments rely on decentralized or semi-regulated infrastructures, where returns are no longer derived solely from traditional banking interest but from the provision of liquidity within regulated digital ecosystems.

For companies, this represents a new frontier in treasury diversification — provided they fully understand the regulatory implications and compliance requirements.

3.2 Investing in stablecoins

Stablecoins are digital currencies pegged to a fiat currency or a basket of assets (such as USDC, EURC, or DAI).

They offer the stability of a value close to the euro or the dollar while providing access to yield-bearing financial services through either centralized (CeFi) or decentralized (DeFi) platforms.

In 2025, returns typically range between 3% and 6% APY, depending on the platform and market conditions.

One of their greatest advantages is liquidity — withdrawals can often be made almost instantly, with no minimum holding period.

From an accounting and tax perspective, stablecoins are recognized as digital assets on the company’s balance sheet, and any gains are taxed under corporate income tax (CIT).

On the compliance side, the MiCA regulation (Markets in Crypto-Assets) now provides a clear legal framework across the European Union.

It prohibits issuers from paying yields directly on stablecoins but allows interest or rewards distributed through regulated intermediaries such as licensed platforms or funds.

In this context, stablecoin investing emerges as a modern and flexible option for companies seeking yield and liquidity — as long as it is conducted within a transparent, regulated framework.

🧾 MiCA

Since 2024, the European MiCA regulation has banned stablecoin issuers from offering direct interest or yield to holders.

Any returns must come from regulated intermediaries — such as compliant CeFi/DeFi platforms or approved investment funds.

Before allocating funds, always verify the MiCA registration of the platform and the audited reserves backing each stablecoin.

3.3 Stablecoins vs traditional investments

| Criterion | Stablecoins | Term deposits | Capitalization contracts |

| Average yield | 3% – 6% | 2% – 4% | 3% – 6% |

| Liquidity | Instant | 30 days | 30 days |

| Main risk | Regulatory / technological | None | Market / issuer |

| Taxation | Standard corporate tax | Standard corporate tax | CIT with capital accumulation benefit |

| Best suited for | Startups, holdings, innovative SMEs | Conservative SMEs | Wealth-holding structures |

Stablecoins should be viewed as a complement, not a replacement, for traditional corporate investments.

They introduce greater performance and liquidity into treasury management while maintaining a healthy balance between traditional finance and the emerging digital economy.

4. Regulatory framework and best practices

4.1 The European framework: MiCA and DORA

The European legal landscape now plays a central role in corporate treasury management — especially when digital assets are involved.

The MiCA regulation (Markets in Crypto-Assets) governs issuers and service providers operating with crypto assets, including stablecoins. It introduces strict requirements on:

- Transparency of reserves held by issuers,

- Licensing with a national competent authority (such as the AMF in France),

- Segregation between an issuer’s own funds and the reserves backing its tokens.

In parallel, the DORA regulation (Digital Operational Resilience Act) sets new cybersecurity and resilience standards for all financial actors — including those offering investment or custody services for digital assets.

For companies, this means ensuring that all intermediaries — platforms, custodians, or advisors — are registered with European authorities and compliant with MiCA and DORA requirements before any investment is made.

4.2 Security and diversification

Caution remains the golden rule in corporate investing: a company should never concentrate all its liquidity into a single asset or instrument.

Diversification must be structured according to different investment horizons:

- Short term: prioritize security and liquidity (term deposits, interest-bearing accounts).

- Medium term: seek a balance between return and stability (capitalization contracts, bonds).

- Long term: focus on performance and appreciation (real estate, financial markets).

It is also essential to verify audits, counterparties’ solvency, and guarantees provided by each institution.

These checks significantly reduce the risks of default, loss, or blocked funds.

4.3 Accounting and taxation of corporate investments

Income generated from corporate investments is subject to corporate income tax (CIT), just like any other financial income.

Unrealized capital gains must be recorded in accordance with accounting standards, particularly at fiscal year-end.

For stablecoin holdings, digital assets must be valued at fair market value at the closing date, and any gains or losses should be included in the company’s taxable results for the period.

This approach ensures transparent and traceable accounting, aligning digital treasury management with traditional financial best practices.

💼 Accounting checklist

- Stablecoin holdings must be valued at fair value on the closing date.

- Returns and yields are taxed under corporate income tax (CIT) like any financial income.

- Always retain transaction records and statements for audit and compliance purposes.

5. What strategy to adopt in 2025?

5.1 Diversify according to needs and time horizons

The foundation of effective treasury management lies in diversification.

Each company should build its strategy based on its specific needs, growth projects, and the length of time it can afford to lock in part of its liquidity.

- Short term: focus on secure and liquid vehicles such as term deposits, regulated stablecoins, or professional savings accounts.

- Medium term: aim for controlled returns through capitalization contracts, selected bonds, or OPCI real estate funds.

- Long term: seek capital appreciation with SCPI real estate investments, equities, or structured products.

A sound investment strategy maintains a balanced mix between yield, risk, and liquidity, ensuring that a sufficient portion of assets remains readily available for operational needs.

5.2 Example of a balanced allocation

| Horizon | Type of investment | Objective | Indicative share |

| Short term | Term deposits, stablecoins | Security and liquidity | 40% |

| Medium term | Capitalization contract | Moderate yield | 35% |

| Long term | Real estate, securities account (CTO) | Capital growth | 25 |

5.3 Our recommendations

- Avoid locking up all liquidity: always keep a portion available for unexpected expenses or fast investment opportunities.

- Prioritize flexibility and compliance: favor transparent, regulated, and easily reversible solutions.

- Monitor rates and market conditions: yields — particularly on stablecoins — evolve quickly in the post-MiCA environment and amid rising interest rates.

By adopting a clear, diversified, and adaptable investment strategy, companies can not only optimize the return on their treasury but also strengthen their financial resilience in a changing economic landscape.

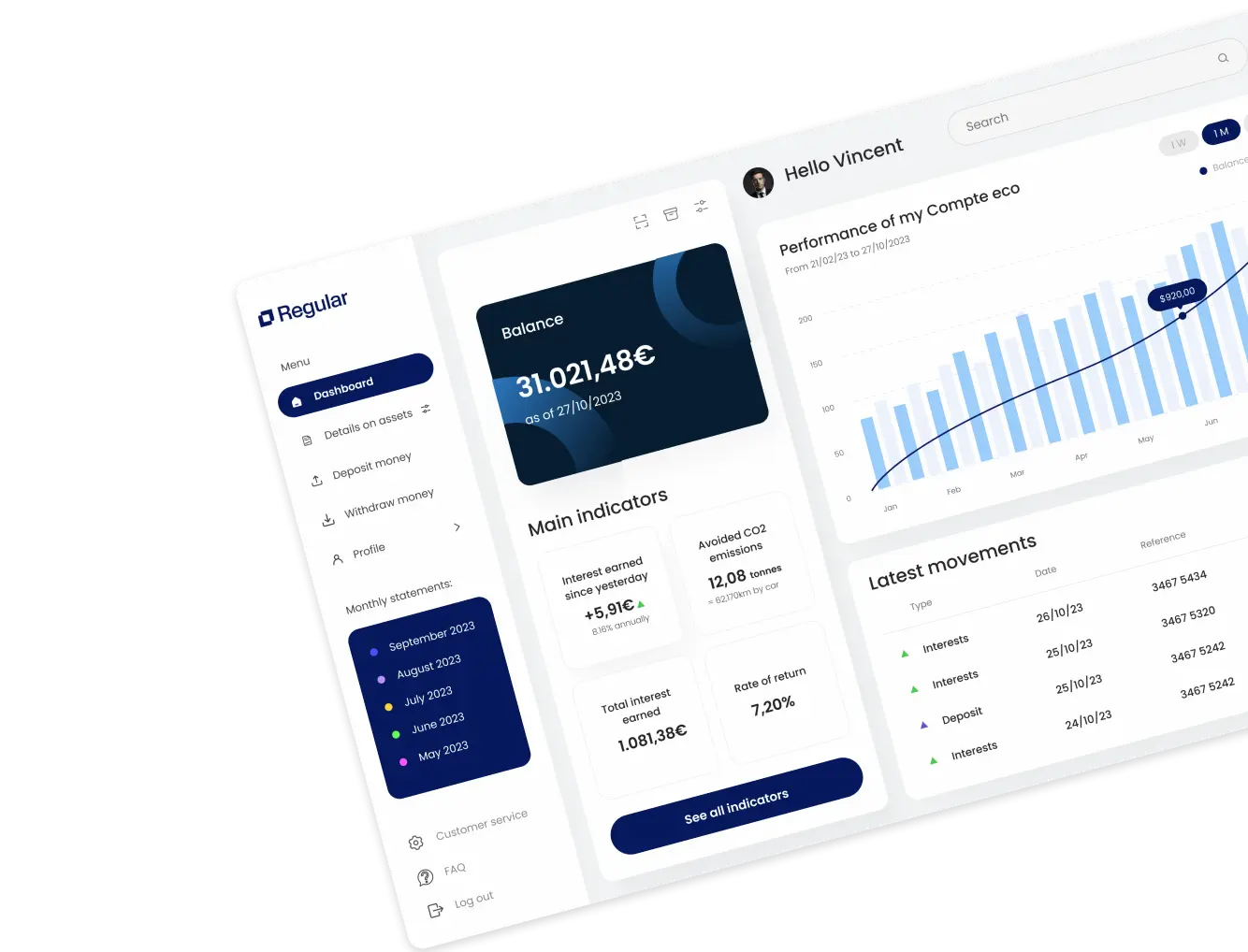

🏢 Regular supports businesses in managing their digital treasury

Our mission: to make stable, liquid, and fully compliant investment solutions accessible to companies.

👉 No speculation, no volatility — just clear reporting and dedicated guidance for business leaders.

In summary

Corporate investing is no longer reserved for large corporations. Between proven banking solutions and new digital opportunities, business leaders now have a full range of tools to optimize their cash management according to their time horizons and risk profiles.

The key lies in finding the right balance between return, security, and liquidity, supported by clear governance — defined investment policies, liquidity thresholds, and risk monitoring.

Today, regulated stablecoins represent a credible complementary asset class: performant, liquid, and now fully supervised under MiCA.

When used responsibly — through regulated intermediaries, with clear exposure limits and transparent reporting — they can enhance and diversify a company’s overall investment strategy.

Frequently Asked Questions – Corporate investments

What is the best investment for a company in 2025?

There is no one-size-fits-all “best” investment. The choice depends on the time horizon, risk tolerance, and liquidity needs.

In 2025:

- Term deposits (CATs) remain the benchmark for short-term, low-risk placements.

- Capitalization contracts suit mid-term investments thanks to their favorable tax treatment.

- SCPI real estate, CTOs, or structured products offer higher long-term performance potential.

- Regulated stablecoins can complement these strategies for companies seeking flexibility and moderate yield.

How can an SME invest its excess cash?

An SME should first separate its operating cash from the portion available for investment.

Then, it can diversify its portfolio:

- Short term: term deposits, business savings accounts, or regulated stablecoins.

- Medium term: capitalization contracts, corporate bonds.

- Long term: real estate through SCPI/OPCI or market investments.

The objective is to balance performance, safety, and liquidity, while keeping a portion readily available for operational needs.

Can a company invest part of its cash in stablecoins?

Yes — but only through MiCA-compliant intermediaries and with a prudent allocation policy.

Stablecoins like USDC, EURC, or DAI typically offer 3% to 6% annual yields while maintaining near-instant liquidity.

However, under MiCA, issuers cannot directly pay interest to holders. Returns must come through regulated platforms or funds.

As a best practice, stablecoin exposure should remain limited to 10–20% of total corporate liquidity.

How are investment gains taxed for companies?

All investment income is subject to corporate income tax (CIT).

- CATs, savings accounts, and capitalization contracts: interest is recorded as financial income.

- SCPI, CTO, and structured products: dividends, rents, and capital gains are added to taxable results.

- Stablecoins: yields and conversion gains follow the same accounting and tax treatment as other investments.

When in doubt, always confirm the accounting method with your company’s chartered accountant.

What are the most liquid investment options?

The most liquid placements allow immediate or near-immediate access to funds without penalties:

- Interest-bearing accounts and short-term term deposits (typically withdrawable within 30 days).

- Regulated stablecoins, convertible almost instantly via compliant platforms.

- Securities accounts (CTO) — equities and ETFs can be sold at market value at any time.

Conversely, real estate vehicles (SCPI/OPCI) or capitalization contracts may require several days or even months to recover the invested capital.

Should a company prioritize safety or yield?

It depends on the company’s profile and goals.

- For those needing immediate access to funds, safety comes first — CATs, savings accounts, and euro funds remain ideal.

- For firms with stable surpluses, it can make sense to seek higher returns through diversified capitalization contracts, real estate, equities, or stablecoins.

In all cases, a company should maintain a diversified and regularly adjusted strategy, aligning with both economic conditions and its operational priorities.