Corporate treasury management is entering a new era.

After years of low interest rates, the sustained rise in yields, persistent inflation, and the introduction of a tighter regulatory framework have fundamentally changed the landscape.

Today, business leaders and CFOs are no longer simply asking where to invest their cash, but how to manage it actively and strategically. The goal is no longer just to earn returns on excess liquidity, but to build a coherent, measurable strategy aligned with the company’s real financial needs.

The objective is clear: to establish efficient treasury management based on balance, security, and liquidity — while taking advantage of the new opportunities offered by both financial markets and regulated digital solutions.

Article summary

In 2025, corporate treasury management becomes a true performance driver.

Between attractive rates, new regulatory requirements, and emerging digital investment tools, companies must learn to structure, diversify, and actively manage their cash positions.

The key: securing liquidity while optimizing returns through a clear, measurable strategy aligned with the European regulatory framework.

1. Corporate treasury: a strategic management lever

1.1 Defining the structure of corporate cash

Before thinking about investments, a company must understand how its treasury is structured. It generally breaks down into three categories:

Operating cash: covers day-to-day needs such as payroll, suppliers, and tax or social obligations. It must remain immediately available.

Contingency cash: acts as a safety buffer to absorb unexpected events or secure business continuity in case of temporary downturns.

Investment cash: represents stable surpluses that can be allocated to medium- or long-term placements.

This approach, often referred to as the “three-pocket method,” clearly separates the funds required for operations from those available for investment. It forms the foundation of a sound and controllable treasury policy.

1.2 Assessing real excess liquidity

Before investing, a company must determine its actual available cash. A miscalculation can weaken its position if a portion of its liquidity becomes locked for too long.

Three key indicators enable this assessment:

- Working capital requirement (WCR): measures the capital needed to finance the operating cycle.

- Fixed and variable expenses: help estimate predictable outflows.

- Cash conversion cycle: reflects the time gap between inflows and outflows.

These elements make it possible to isolate the portion of cash that can safely be invested without jeopardizing the company’s financial stability.

Simple formula to estimate investable liquidity:

Investable cash = Total cash – (WCR + safety buffer equivalent to 1–3 months of operating expenses)

1.3 The new challenges of 2025

In 2025, treasury management evolves from a matter of caution to a true performance driver.

The sustained rise in interest rates creates fresh opportunities for returns, but also new risks: market volatility, liquidity pressures, and tighter regulatory expectations.

To navigate this environment, every company should implement a documented treasury policy that includes:

- clear objectives for yield and security,

- a defined minimum liquidity threshold,

- formalized decision-making and rebalancing procedures,

- regular monitoring and reliable reporting mechanisms.

This structured approach transforms treasury management into a strategic asset—serving both financial control and long-term stability.

2. Designing an investment policy aligned with your company profile

2.1 Setting priorities: security, liquidity, or yield?

Every company has its own financial structure, business cycle, and risk appetite.

Before selecting any corporate investment vehicle, it’s essential to define your main priority — security, liquidity, or performance.

- Startup or early-stage company: the priority is flexibility and liquidity. The goal is to preserve the ability to invest quickly while keeping excess cash secure.

- Established SME: balance between safety and return. With greater visibility on cash flows, a portion of liquidity can be allocated to higher-yield instruments, while maintaining a safety buffer.

- Holding or investment company: long-term horizon, yield optimization, and tax efficiency. These structures can include less liquid investments such as real estate funds (SCPI), bonds, or capitalization contracts.

For example, a service company must maintain a significant cash buffer to absorb client payment delays, whereas a manufacturing firm with tangible assets can afford to lock up a larger portion of its surplus in deferred-return instruments.

2.2 Building an investment matrix

An effective treasury investment policy relies on a clear allocation framework — one that matches the company’s risk profile and investment horizon.

The goal is to strike a balance between performance and availability, ensuring that chosen instruments align with operational needs.

| Company Profile | Investment Horizon | Target Yield | Liquidity Level | Example Instruments |

| Startup / SaaS | Short term (0–12 months) | 2–3% | Very high | Term deposits, regulated stablecoins |

| Established SME | Medium term (1–3 years) | 3–5% | Moderate | Capitalization contracts, bonds, SCPI |

| Holding / Investment company | Long term (3–7 years) | 5–7% | Low to moderate | Securities account, real estate, structured products |

This matrix helps simplify decision-making and visualize trade-offs between yield, duration, and flexibility.

2.3 Setting up an internal validation process or treasury committee

An investment policy should always be governed by a clear decision-making framework.

Creating a treasury committee, or at least an internal validation process, helps secure investment decisions and prevents inconsistencies with the overall financial strategy.

This committee may include:

- Finance management: for oversight and strategic allocation,

- Accounting department: for tracking and recording operations,

- External advisor (optional): such as a CPA, wealth manager, or investment consultant.

These principles can be formalized in a treasury management charter, outlining:

- objectives for yield and security,

- allocation limits per asset class,

- procedures for rebalancing and reporting,

- frequency of reviews and validations.

Such governance strengthens transparency, traceability, and long-term consistency in the company’s treasury investment strategy.

3. Investment vehicles to include in your treasury strategy

3.1 Banking products: simplicity and visibility

Bank deposits remain the foundation of any conservative treasury strategy. They offer a clear framework, predictable returns, and controlled liquidity.

The main instruments available include:

- Term deposits: fixed-rate investments over a defined period, ideal for securing a short-term investment from surplus cash. In 2025, yields typically range between 3% and 4.5%.

- Interest-bearing accounts: a flexible option to keep cash available while earning daily interest on the balance.

- Notice deposits: an intermediate solution allowing withdrawals within 15 to 90 days, depending on contractual terms.

These instruments provide full visibility on returns and are particularly suitable for risk-averse companies or those that need to maintain a high level of reactivity.

3.2 Actively managed investments

Active management vehicles help optimize profitability without entirely sacrificing liquidity. They are designed for companies with a stable surplus, willing to lock in part of their cash for 12 to 36 months.

Common options include:

- Capitalization contracts: available to legal entities, combining guaranteed euro-denominated funds and unit-linked assets (bonds, real estate, diversified funds). Average yields range from 3% to 6%, depending on the risk profile.

- Dated bonds: fixed-maturity debt instruments offering a known yield and controlled duration — useful for forecasting performance over a defined period.

- Dynamic money-market funds: low-risk vehicles whose returns follow short-term interest rate movements, often outperforming standard savings accounts.

These instruments strike a balance between performance and flexibility, supported by clear reporting (monthly or quarterly) for accurate tracking.

3.3 Long-term investment solutions

Companies with sustained cash surpluses can consider longer-term placements to pursue higher returns and broader diversification.

The main options include:

- SCPI (French real estate investment companies): allow investment in professionally managed property portfolios. Average yields range from 4% to 6%, with a recommended holding period of at least five years.

- Structured products: financial instruments combining potential returns with partial capital protection, suited to businesses willing to take measured market exposure.

- Moderate private equity: indirect participation in unlisted companies through specialized funds. Recommended for holdings or investment structures capable of immobilizing capital for several years.

While these options offer higher potential returns, they come with lower liquidity. They are best suited to mature, well-capitalized companies with a long-term financial outlook.

Key indicators for monitoring treasury investments

- IRR (Internal Rate of Return): measures the annualized average performance of an investment.

- Volatility: reflects the stability or variability of returns over time.

- Turnover rate: tracks the frequency of reallocations or withdrawals — useful for assessing liquidity management efficiency.

4. Integrating digital and tokenized solutions

4.1 Regulated digital assets

Recent financial innovations are providing companies with new treasury placement options built on blockchain technology. However, it’s important to distinguish between two categories:

- Speculative crypto-assets — such as volatile cryptocurrencies like Bitcoin or Ether — designed for speculation and unsuitable for corporate treasury management.

- Regulated digital treasury assets — such as stablecoins — designed to maintain a stable value and remain compliant with accounting and tax standards.

These instruments are not alternative currencies but digital liquidity tools, backed by fiat currencies (euro, dollar) or verified reserves. They offer moderate yields while maintaining near-instant liquidity.

4.2 Stablecoins as a liquidity tool

Stablecoins are digital tokens backed by underlying assets, maintaining parity with a reference currency (e.g., 1 EURC = 1 euro). They represent a modern and liquid treasury vehicle for businesses.

In 2025, available stablecoins yields typically range between 3% and 6%, depending on the platform and risk level. Their main advantage lies in immediate liquidity — funds can be accessed at any time, with no penalties or lock-up period.

Their use is now framed by the MiCA Regulation (Markets in Crypto-Assets), which imposes strict rules on issuers and intermediaries, including:

- mandatory European licensing,

- transparency on reserve composition,

- segregation between issuer capital and backing assets.

Stablecoins are particularly useful for intercompany or holding transfers: they enable quick, compliant fund movements between subsidiaries or the placement of surplus liquidity on yield-bearing instruments.

Regulated stablecoins ≠ speculative crypto products

- No speculation or volatility: stable value backed by reserves.

- Strict European supervision under MiCA.

- Purpose: liquidity management, not speculative investment.

4.3 The rise of tokenized finance

Tokenization is no longer limited to digital currencies — it now extends to traditional financial instruments, such as:

- digital bonds,

- tokenized debt securities,

- dematerialized fund shares.

These innovations allow access to more transparent investments, with real-time tracking and shorter settlement cycles. Some regulated platforms already offer tokenized treasury accounts, where interest payments, maturities, and transactions are automatically recorded on the blockchain.

Tokenized finance thus represents a natural extension of modern treasury management — combining regulatory rigor, transparency, and technological efficiency, while remaining fully compatible with European accounting and compliance frameworks.

5. Governance, compliance, and performance monitoring

5.1 Regulatory framework: MiCA, DORA, and European compliance

Regulatory compliance has become a cornerstone of corporate investment policies in 2025.

Companies must ensure that all intermediaries and platforms they use meet strict European standards, including:

- Official authorization or registration with a recognized regulator (e.g., AMF, BaFin, CSSF).

- Full traceability of funds and reserves for any digital asset held.

- Operational and cybersecurity compliance with the DORA regulation (Digital Operational Resilience Act), ensuring technological resilience and business continuity.

Cybersecurity now plays a central role in financial resilience. Measures such as multi-factor authentication, regular audits, access control, and system redundancy should be clearly defined within every corporate treasury charter.

5.2 Accounting and taxation

Corporate investments — whether banking, financial, or digital — must be recorded and valued in accordance with French and European accounting standards (IFRS or PCG).

Key accounting principles:

- Fair value valuation at the end of each fiscal period.

- Recognition of financial income (interest, capital gains) within taxable profit, subject to corporate income tax (CIT).

- Comprehensive documentation of all operations, including account statements, supporting evidence, and intermediary reports.

For digital assets (such as stablecoins or tokenized bonds), the same logic applies: unrealized gains and losses must be reflected in taxable results, and conversions into euros must be properly justified in accounting records.

Year-end accounting checklist

- Revalue each investment as of the closing date.

- Include interest and capital gains in taxable income.

- Keep transaction records and compliance certificates.

- Verify consistency between internal reporting and official financial statements.

5.3 Reporting and performance tracking

Regular monitoring of invested treasury funds ensures strategic consistency and sustained performance over time.

Setting up a treasury dashboard allows companies to consolidate key indicators such as:

- allocation by investment type,

- weighted overall return,

- average yield,

- average holding period,

- proportion of liquid assets available.

This reporting can be updated monthly or quarterly, depending on company size and risk profile.

It facilitates informed decision-making, enabling timely reallocation of funds in response to market changes, while maintaining full transparency for management and auditors.

5 key performance indicators (KPI) for treasury management

- Net overall yield (annual %)

- Share of liquid assets (target > 30%)

- Average holding duration

- Security/performance ratio (internal weighting)

- Compliance and traceability rate of investments

6. Practical example: a sample treasury allocation strategy for 2025

Case study: SME with €500,000 in available cash.

| Objective | Instruments | Time horizon | Suggested allocation | |

| Safety | Immediate availability | Term deposits, regulated stablecoins | < 6 months | 40% |

| Performance | Moderate yield | Capitalization contracts, bond funds | 6–24 months | 35% |

| Growth | Long-term value creation | SCPI, structured products, securities account (CTO) | > 24 months | 25% |

This allocation reflects a balanced approach combining safety, performance, and liquidity.

It allows the SME to maintain operational agility while maximizing returns on its surplus cash.

How to adjust the allocation according to market conditions:

- If interest rates rise: strengthen the Safety pocket (term deposits, money-market funds).

- If markets stabilize: increase the Growth allocation to capture higher long-term value.

- In times of uncertainty: keep at least 40% of funds fully liquid and available immediately.

7. Recommendations for 2025

Formalize a written treasury investment policy

Clearly define allocation rules, liquidity thresholds, approval processes, and authorized counterparties.

Review the strategy every six months

Interest rate conditions and yields evolve quickly. A biannual review ensures optimal rebalancing of instruments and horizons.

Diversify counterparties

Distribute funds across several banks, asset managers, and MiCA-regulated platforms to mitigate counterparty risk.

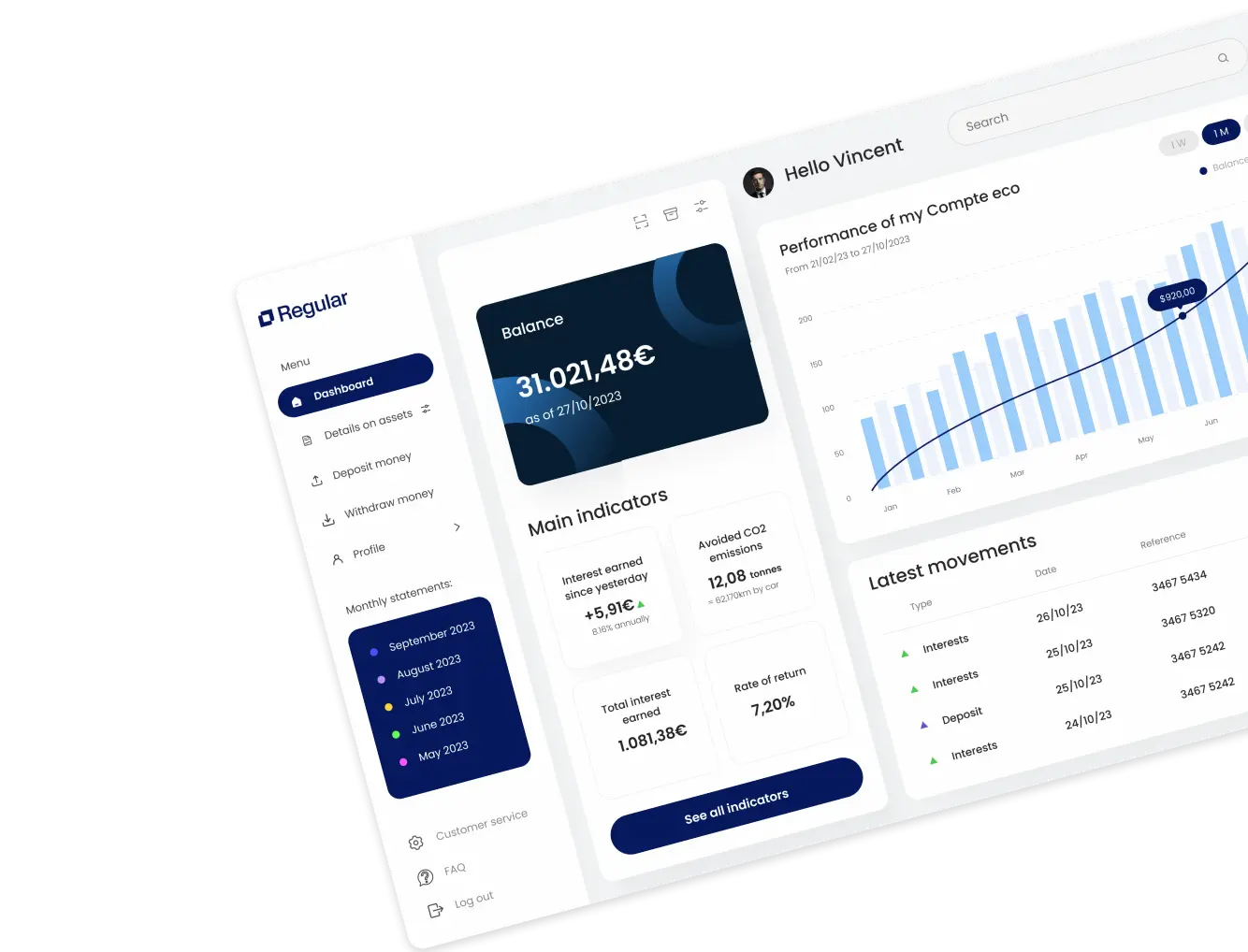

Regular helps companies build stable and compliant treasury strategies

- Selection of secure and liquid instruments.

- 100% compliance with the European regulatory framework.

- Transparent reporting and dedicated support for executives.

Conclusion

Treasury management is no longer a passive or purely administrative exercise — it has become a strategic lever of performance, control, and resilience.

Companies that successfully structure their cash, document their allocation choices, and diversify across traditional and digital instruments strengthen both returns and security.

In 2025, success lies in balance — combining financial discipline, controlled diversification, and openness to innovation — to build a more agile, measurable, and sustainable treasury.

Frequently Asked Questions – Corporate Treasury Investment

How much of a company’s cash can be safely invested?

Start by separating your cash into three distinct “pockets” before investing anything:

- Operating treasury: working capital + fixed expenses for 1–3 months.

- Contingency treasury: 2–4 months of variable costs and unexpected expenses.

- Investable surplus: everything beyond those two cushions.

Only once the first two pockets are secured should the surplus be placed in capital-guaranteed or low-risk instruments.

In practice, many SMEs can safely allocate 20–50% of total cash to investments, though the right percentage depends on collection cycles, seasonality, and supplier terms.

A simple stress test helps determine your margin: simulate a 20% revenue drop over three months — if your operating + contingency treasury still covers outflows, the remainder can be invested. That residual amount becomes your investment base.

How can a company balance liquidity and yield?

Use a combination of complementary techniques:

- Laddering maturities: stagger term deposits to regularly free up capital without penalties.

- Barbell strategy: allocate one side to highly liquid instruments (interest-bearing accounts, money market funds, regulated stablecoins) and the other to longer, better-yielding positions (dated bonds, capitalization contracts).

- Modular tranches: split funds (e.g., 5 × 20%) to rebalance gradually rather than liquidating everything.

- Liquidity thresholds: always keep a floor of T+0/T+2 assets (immediate to 2-day access) and commit yield-oriented pockets only beyond that limit.

Should a company create an internal investment policy?

Yes — a formalized written policy strengthens governance, reduces operational risks, and speeds up decision-making.

It should define:

- Objectives: target yield, liquidity thresholds, and risk tolerance.

- Eligible instruments and maximum allocation by asset class.

- Approved counterparties: banks, asset managers, MiCA-regulated providers, and limits per counterparty.

- Decision processes: who proposes, who validates, who executes.

- Reporting rules: KPIs, frequency, alerts, and review cycles.

Add a few simple safeguards:

- At least 30–40% in liquid assets available within 30 days.

- No single counterparty representing more than 25% of total exposure.

- Digital assets capped at 10–20% of investable surplus.

Can stablecoins replace traditional bank placements?

No — they complement them.

Regulated stablecoins primarily serve as high-liquidity tools, enabling instant settlement between entities and competitive yields via compliant intermediaries.

However, they come with specific risks (regulatory, operational, custody-related) and must be handled through MiCA-compliant partners.

Best practice: include them as part of your liquidity or short-term yield pocket, with clear exposure limits, rather than using them as a full substitute for bank deposits or term accounts.

How are treasury investment returns taxed?

In general, investment income is subject to corporate income tax (CIT):

- Term deposits, interest-bearing accounts, money market funds: interest booked as financial income and taxed under CIT.

- Securities accounts (stocks, bonds, ETFs, structured products): dividends and coupons taxed upon receipt; capital gains taxed upon sale (subject to fund-specific rules).

- Capitalization contracts (eligible corporate holders): no annual tax on unrealized gains; forfaitary mechanism based on TME (government bond yield) with final adjustment at exit.

- Digital assets / stablecoins: fair value revaluation at year-end; interest and conversion gains recognized in income and taxed under CIT.

Tax treatment may vary depending on company status (operational entity vs. holding, association, SCI) and holding structure.Align accounting methods with your chartered accountant and document them in your treasury policy for consistency and audit traceability.