In 2025, treasury management is entering a new era.

Companies are no longer looking to speculate on crypto investment, but instead aim to leverage digital tools that are now regulated, stable, and compliant.

Active digital investment is emerging as a new strategic lever: it enables businesses to make their cash work through regulated, liquid, and high-yield digital instruments, all within the MiCA framework.

💡 In short: digital finance has become a natural extension of corporate finance.

Summary

In 2025, active digital investment is becoming a strategic solution for companies seeking to optimize their treasury without stepping outside the regulatory perimeter.

Governed by MiCA and DORA, it stands on three pillars: security, liquidity, and performance.

Regulated stablecoins, tokenized bonds, and hybrid digital funds now offer 3% to 6% yields, backed by audits and transparency.

More than an alternative, this is the natural evolution of corporate finance — a modern, compliant, and measurable way to manage cash.

Context: The New Era of Digital Treasury

Real interest rates are stabilizing, term deposits are becoming attractive again, and financial digitalization is taking hold across all finance departments.

In this environment, active digital investment is emerging as a strategic arbitrage tool — helping companies activate idle cash while maintaining the same guarantees as a traditional banking product.

The goal is not to replace banks, but to optimize corporate cash within a regulated, audited, and interoperable framework that integrates seamlessly with traditional finance.

Thanks to blockchain technology and European regulation, companies can now combine transparency, speed, and performance within a controlled and compliant environment.

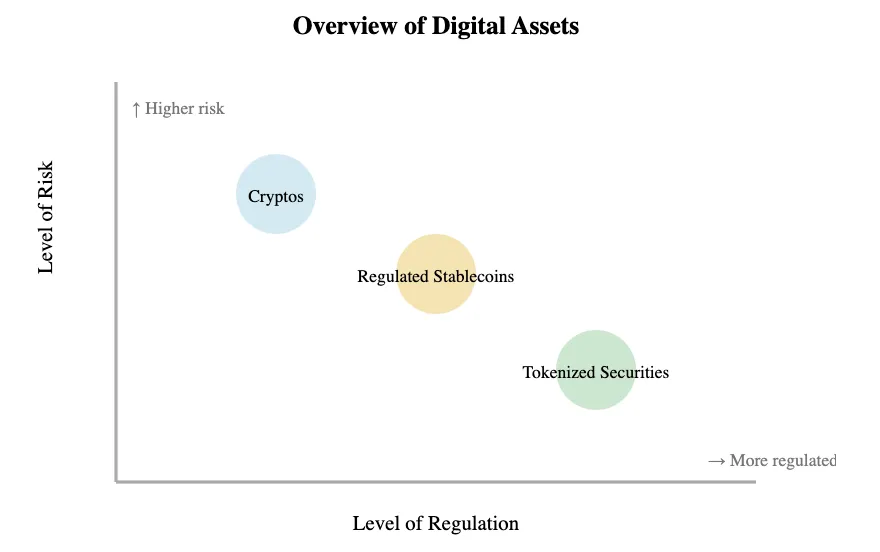

Definition: Understanding What a Digital Asset Is

A digital asset is an intangible value stored, exchanged, or transferred electronically.

It combines a technological dimension (blockchain, tokenization) with a real economic value (monetary, financial, or utility-based).

It can represent:

- a digital currency, such as a stablecoin or CBDC (central bank digital currency);

- a tokenized security, such as a digital bond or a fund share;

- or a digital right, such as a license, utility NFT, or symbolic access asset.

💡 Key takeaway:

Not all digital assets are cryptocurrencies.

Active digital investment focuses on stability and compliance, not speculation.

The European Regulatory Framework

MiCA and PSCA

Since 2024, the MiCA Regulation (Markets in Crypto-Assets) has officially established a legal framework for digital assets across the European Union.

It defines the conditions for issuing, holding, and managing these assets, while introducing a unified status: the PSCA (Crypto-Asset Service Provider).

Any entity offering services related to digital assets — including custody, exchange, management, or advisory — must now be registered and authorized as a PSCA to operate legally in Europe.

DORA and Security

The DORA Regulation (Digital Operational Resilience Act) complements MiCA by enforcing strict standards on cybersecurity, operational resilience, and risk management for digital-asset providers.

Its goal: to protect companies and investors from technical incidents, cyberattacks, and infrastructure failures.

⚖️ Good to know:

You can verify any authorized provider on the AMF’s official whitelist.

Only MiCA- and PSCA-compliant actors are legally permitted to issue, manage, or safeguard digital assets within the EU.

At the same time, new models are emerging around decentralized finance (DeFi) — bridging innovation and compliance in the European market.

⚠️ Disclaimer:

Digital-asset investments involve a risk of capital loss.

Past performance is not indicative of future results.

The Different Forms of Active Digital Investment

1. Regulated Stablecoins

Regulated stablecoins are digital assets pegged to a fiat currency (EUR, USD) and issued by an authorized institution.

They are 100% collateralized, undergo regular independent audits, and provide full transparency on their reserves.

Key features:

- 100% collateralized and backed by fiat assets

- Regular audits and full transparency

- Average stablecoins annual yield: 3–6%

💬 Corporate use case:

Allocate part of the company’s treasury to regulated stablecoins to earn yield while maintaining instant liquidity (T+0).

2. Tokenized Bonds and Securities

Tokenized bonds represent the digital version of real financial instruments — such as private debt, corporate bonds, or fund shares.

They offer fixed returns and clear investment horizons, with simplified access through regulated platforms.

Key features:

- Fixed yield with visibility at maturity

- Access via licensed and regulated platforms

- Typical investment horizon: 6–24 months

3. Hybrid Digital Funds

Hybrid digital funds combine traditional financial assets with regulated digital instruments, delivering the best of both worlds — stability, yield, and innovation.

Key features:

- Delegated and audited management

- Average annual yield: 4–6%

- Automated reporting and blockchain-based traceability

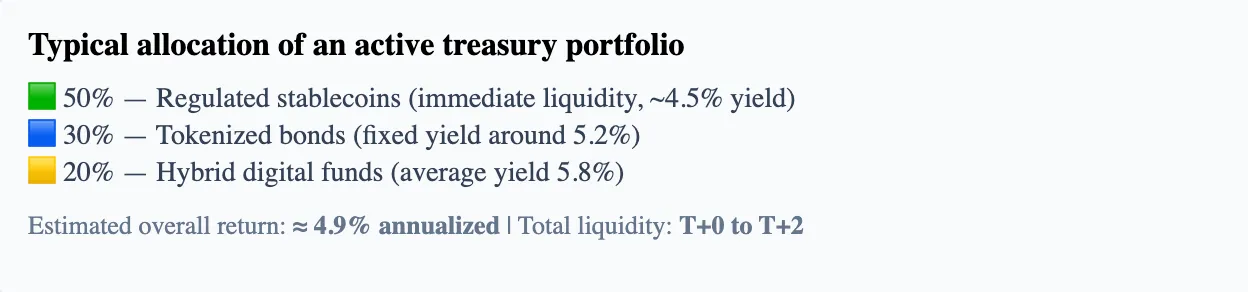

Comparative Table of Active Digital Investment Options

| Asset Type | Average Yield | Risk Level | Liquidity | Regulatory Framework |

| Regulated Stablecoin | 3–6 % | Low | T+0 (Instant) | MiCA |

| Tokenized Bond | 5–7 % | Moderate | T+2 | MiCA / DORA |

| Hybrid Digital Fund | 4–6 % | Low to Moderate | J+1 (Next Day) | AMF |

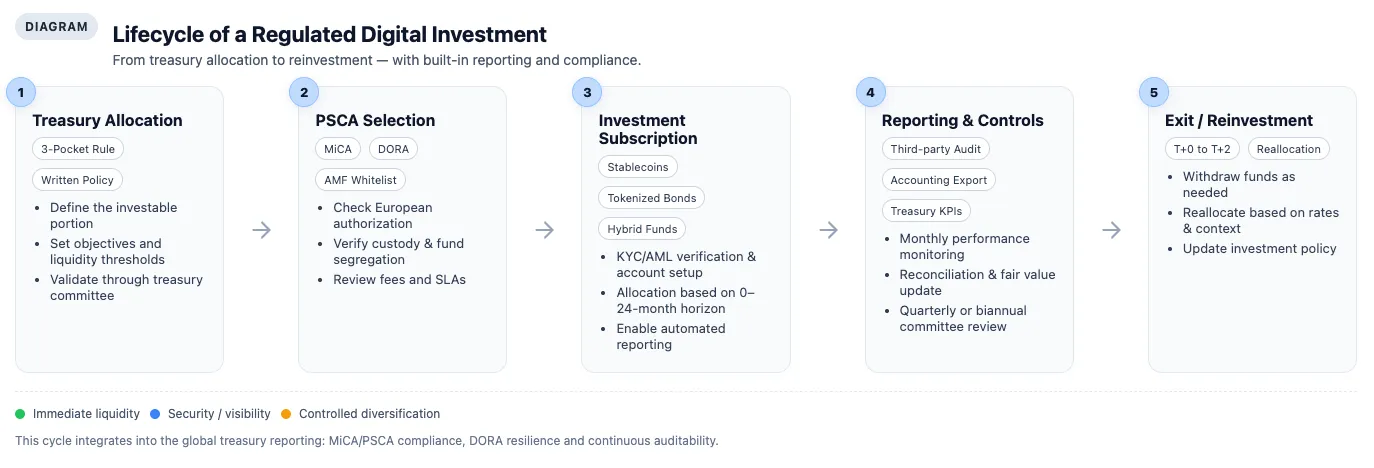

Building an Active Digital Investment Strategy

Building an active digital investment strategy means structuring your corporate treasury around three key dimensions: availability, security, and performance.

The goal is not to chase the highest yield, but to ensure coherence between horizon, liquidity, and compliance.

Identifying the Deployable Portion

Before any allocation, companies must determine which part of their treasury is truly available:

- Operational pocket → funds required for daily operations (expenses, salaries, suppliers).

- Security pocket → stable reserves placed in short-term guaranteed instruments (term deposits, regulated stablecoins).

- Yield pocket → surplus cash that can be allocated to regulated digital assets with a longer investment horizon.

🧩 The Three-Pocket Rule

- Operational: immediate liquidity.

- Security: stable, low-risk placements.

- Yield: regulated digital assets to grow surplus cash.

Segmenting by Investment Horizon

A robust strategy is built on a clear temporal segmentation — each horizon aligns with a specific objective and asset type.

| Horizon | Objective | Type of Investment |

| 0–3 months | Maximum liquidity | Regulated stablecoins (T+0 liquidity) |

| 3–12 months | Security + moderate yield | Tokenized bonds or digital securities |

| 12–24 months | Controlled performance | Hybrid digital funds |

Monitoring and Performance Tracking

Active placement requires continuous oversight to remain aligned over time.

- Reassess the strategy every 3 to 6 months.

- Track overall yield and true liquidity ratios.

- Adjust allocation according to interest rates, treasury needs, or regulatory changes.

💡 Pro Tip:

The best active investment is not the one with the highest yield —

it’s the one that remains compliant, liquid, and measurable.

Taxation and Compliance

Income generated from digital asset placements — whether regulated stablecoins, tokenized bonds, or digital funds — is subject to corporate income tax (CIT), just like traditional financial investments.

All generated revenues (interest, yields, or capital gains) are included in the company’s financial income for the fiscal year.

Digital assets are valued at fair market value at the end of each accounting period.

Any conversion gains or losses are recorded as financial income or expenses, depending on their nature.

This alignment with traditional accounting rules enhances transparency and traceability, provided that companies maintain proper documentation and audit trails.

Best Practices

✅ Work exclusively with MiCA- or PSCA-authorized providers

✅ Keep monthly statements and independent audit reports for each investment vehicle

✅ Integrate digital asset placements into the global treasury reporting system

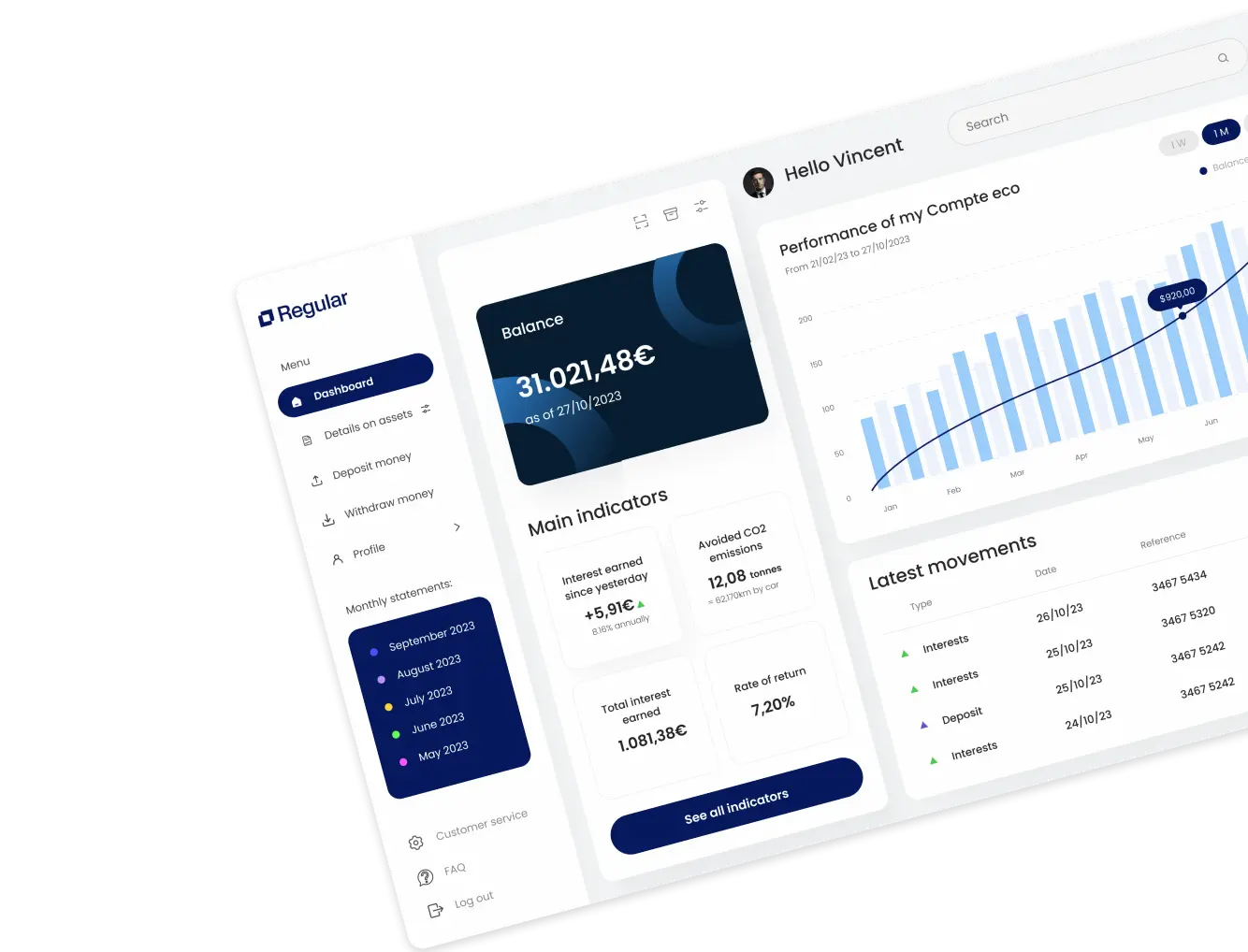

Managing Active Digital Investments

Once the investment vehicles are selected, strong governance and regular oversight are key to long-term success.

Digital asset placements should be fully integrated into the company’s treasury management system, just like bank accounts.

Best management practices include:

- Centralizing all statements within a unified accounting tool

- Performing monthly verification of audit reports provided by the PSCA

- Conducting semi-annual fair value reviews with the accountant or auditor

🧾 Regular Compliance Checklist

✅ PSCA-licensed platform operating in the EU

✅ Monthly reports and third-party audits available

✅ Integrated accounting export

✅ MiCA-compliant documentation and proof of regulatory status

Advantages and Limitations

Strengths

Active digital investments combine performance and flexibility within a fully regulated framework.

Among their key advantages:

- Higher yields than traditional bank deposits

- Instant liquidity, especially through regulated stablecoins

- Full transparency, ensured by blockchain technology and regular third-party audits

These features make it an ideal solution for companies looking to enhance treasury performance without compromising on security or regulatory compliance.

Limitations

However, a few points of attention remain:

- Residual volatility, depending on the type of digital asset

- Evolving tax framework, requiring ongoing regulatory monitoring

- Reliance on MiCA/PSCA-licensed providers, who ensure both compliance and asset custody

⚠️ To Avoid

❌ Unregulated or non-EU platforms

❌ “Guaranteed” or abnormally high yields

❌ Lack of audits, attestations, or transparency on reserves

Digital Finance Comes of Age

The line between traditional and digital finance is disappearing.

Stablecoins, tokenized bonds, and hybrid funds are no longer niche innovations — they’ve become modern, regulated, and profitable treasury management tools.

Active digital investment isn’t a disruption — it’s the logical evolution of corporate treasury: more transparent, more liquid, and more efficient.

💬 Key takeaway:

The future of digital investment isn’t about crypto speculation —

it’s about a stable, transparent, and regulated digital finance ecosystem.

FAQ – Active Digital Investment

What is a regulated digital asset?

A regulated digital asset is a financial instrument issued, held, or exchanged under the supervision of a recognized authority — in accordance with the MiCA regulation (Markets in Crypto-Assets).

It may take the form of a stablecoin, a tokenized security, or a hybrid digital fund.

These assets are subject to strict requirements: reserve transparency, independent audits, client fund segregation, and regular public reports.

In short: it’s the audited and verifiable version of digital finance, designed to give companies the benefits of blockchain — without the risks of unregulated crypto.

What’s the difference between a crypto asset and a stablecoin?

A crypto asset refers to any blockchain-based digital asset (e.g., Bitcoin, Ethereum) whose value fluctuates freely based on market demand and supply.

A regulated stablecoin, on the other hand, is backed by a real-world currency (euro, dollar, etc.) and aims to maintain a stable value over time.

- The former is speculative.

- The latter is a management tool — used by companies for its stability, traceability, and regulated yield, especially in short-term treasury allocations.

How can I verify if a provider is PSCA-licensed?

Since 2024, any entity offering digital asset services in Europe must hold a PSCA (Crypto-Asset Service Provider) license.

To verify compliance:

- Check the AMF whitelist (or your local authority’s registry).

- Confirm that the provider lists its MiCA/PSCA registration number.

- Look for the presence of third-party audits or compliance certificates.

If a platform isn’t listed, do not transfer funds, even for testing purposes.

What taxation applies to digital investment returns?

Revenues from digital placements — including interest, capital gains, and tokenized yields — are treated as financial income and subject to corporate income tax (CIT).

Digital assets are valued at fair market value at the end of the fiscal year, and any variations are recorded as gains or losses in the financial statements.

Companies should also retain:

- Monthly reports from platforms

- MiCA audit certificates

- Clear documentation within their treasury reporting

Can digital assets be combined with traditional investments?

Yes — and this is often the most balanced strategy.

A modern treasury portfolio can combine:

- Regulated stablecoins for immediate liquidity (T+0)

- Tokenized bonds for fixed mid-term returns

- Traditional banking products (term deposits, money market funds) for stability

- Hybrid funds for controlled diversification

The goal is to build a unified treasury ecosystem —

where digital assets complement, not replace, traditional placements.

In summary: the future of treasury management is hybrid — digital, regulated, and interoperable with traditional finance.