In 2025, Decentralized Finance (DeFi) stands out as one of the most profound transformations in the global financial landscape.

Built on blockchain technology, it redefines the rules of investment, credit, and savings by removing traditional intermediaries — banks, brokers, and financial institutions — and replacing them with autonomous, transparent protocols governed by code.

This new form of finance allows both individuals and businesses to invest, lend, borrow, or trade directly — anytime, anywhere — without relying on a centralized entity.

The returns it offers can be substantial, often higher than those in traditional finance, driven by greater operational efficiency and interconnected global markets.

However, behind this promise of autonomy and performance lie real risks: the volatility of digital assets, the technical complexity of protocols, potential security vulnerabilities, and ongoing regulatory uncertainty.

In other words, DeFi blends financial innovation with heightened risk, creating a field of opportunity — provided one understands its mechanics.

This article explores how DeFi works, its key applications, advantages, risks, and the best practices for approaching decentralized investments in a prudent, compliant manner aligned with upcoming European regulations.

Article Summary

In 2025, DeFi is reshaping global finance: open protocols enable lending, investing, and trading — all without banks.

High yields, autonomy, and transparency attract investors, yet technical and regulatory risks remain significant.

Under the MiCA and PSCA frameworks, DeFi is entering a new phase — one that bridges blockchain innovation and European financial regulation.

What Is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, refers to a network of financial protocols built on blockchain technology that allows users to carry out lending, investing, and exchange operations without centralized intermediaries.

The goal is simple: to replace traditional financial institutions with autonomous, transparent, and universally accessible software systems.

At the heart of this ecosystem are smart contracts — self-executing programs stored on the blockchain.

These contracts automatically perform transactions as soon as the specified conditions are met — no human intervention, no bank, no central authority required.

In practice, DeFi allows any user to:

- Lend or borrow cryptocurrencies through lending protocols (e.g., Aave, Compound)

- Exchange digital assets on decentralized platforms known as DEXs (e.g., Uniswap, Curve)

- Earn yield through staking (locking tokens to secure a network) or yield farming (providing liquidity to protocols in exchange for rewards)

These tools operate in an open, automated environment, offering global access to financial services that were once exclusive to institutions.

💡 Key takeaway:

DeFi doesn’t replace banks — it reinvents them.

It automates trust through transparent code and the security of blockchain, profoundly transforming our relationship with finance.

How Does DeFi Work?

Decentralized Finance is built on a technological infrastructure that is open, automated, and interconnected.

Its operation relies on three essential pillars: blockchain, smart contracts, and tokens.

Together, they form an ecosystem without intermediaries, where every user maintains full control over their assets.

1. Public Blockchains: The Foundation of Trust

The blockchain is the distributed ledger that underpins the entire DeFi ecosystem.

Every transaction is recorded transparently, immutably, and verifiably by all participants.

There is no central server — the data is replicated across thousands of computers worldwide.

The most widely used blockchains in DeFi include:

- Ethereum, the pioneer and reference standard for smart contracts.

- Solana, Avalanche, and Arbitrum, which offer lower fees and higher transaction speeds.

💡 In practice:

Each DeFi protocol deployed on a blockchain functions as an “open financial application”, where all the operating rules are embedded directly in the network’s code.

2. Smart Contracts: The Engine of Automation

Smart contracts are autonomous programs that execute automatically once predefined conditions are met.

They replace traditional intermediaries — such as banks, brokers, or notaries — by guaranteeing the reliable and automatic execution of a transaction.

Examples:

- When a user deposits 1 ETH as collateral, the contract automatically issues a stablecoin loan.

- When a trade is executed on Uniswap, the contract instantly distributes transaction fees to liquidity providers.

These programs are open-source, auditable, and transparent, allowing anyone to review their logic before investing.

💡 This full automation makes DeFi a trustless system — not in the sense of being untrustworthy, but because it eliminates the need for human trust, relying instead on the integrity of the code.

3. Tokens: The Currency and Value of the Network

Tokens are the core value units of the DeFi ecosystem.

They represent different categories of digital assets, each serving a distinct purpose:

- Cryptocurrencies: native assets such as ETH or SOL, used to pay fees and secure the network.

- Stablecoins: tokens pegged to fiat currencies (e.g., USDC, EURCV, DAI) to minimize volatility.

- Governance tokens: grant voting rights on protocol decisions (e.g., UNI, AAVE).

- Liquidity tokens: represent shares in liquidity pools, generating variable returns.

These tokens are traded directly between users without any central authority, thanks to programmable blockchain logic.

4. User Access: Through a Wallet

To interact with DeFi protocols, users need a crypto wallet such as MetaMask or Rabby.

A wallet allows users to:

- Securely store their tokens in full self-custody

- Sign blockchain transactions with their private keys

- Connect to DeFi applications like Uniswap, Aave, or Curve

Wallets are the gateway to the financial Web3:

you are your own bank, your own vault, and your own operator.

The Main Use Cases of DeFi

Decentralized Finance is structured around several core applications that replicate, enhance, or automate traditional financial services.

These use cases form the foundational pillars of the DeFi ecosystem:

| Use Case | Leading Protocols | Function | Average Yield |

| Lending / Borrowing | Aave, Compound | Lend your crypto assets or borrow using collateral | 3–8% |

| Decentralized Exchanges (DEX) | Uniswap, Curve | Swap tokens without going through a central exchange | Variable |

| Staking / Yield Farming | Lido, PancakeSwap | Lock tokens to earn staking rewards or provide liquidity | 4–12% |

| Decentralized Insurance | Nexus Mutual | Protect funds against hacks or smart contract failures | Variable |

Why Investors Are Drawn to DeFi

DeFi continues to attract a growing number of investors for four main reasons:

- Attractive returns – often higher than traditional financial products.

- Autonomy – investors retain full control of their assets, without intermediaries.

- Transparency – every transaction is traceable and verifiable on the blockchain.

- Innovation – access to automated, global financial products available 24/7.

⚖️ Real-world example:

Protocols like Aave and Uniswap each manage billions of dollars in Total Value Locked (TVL) — a strong indicator of trust, adoption, and liquidity within the DeFi ecosystem.

Risks to Be Aware Of Before Investing

The absence of intermediaries in DeFi also means total responsibility falls on the investor.

Without a bank or insurer to rely on, your funds remain entirely under your control — but also entirely at your risk.

Here are the main risks to consider:

- High volatility – crypto assets can fluctuate in value by double digits within hours.

- Technical risk – vulnerabilities or hacks within smart contracts.

- Liquidity risk – funds can become locked in empty or unbalanced liquidity pools.

- Regulatory uncertainty – a lack of clear legal recourse in case of disputes.

- Fraud and scams – fake platforms or unrealistic “guaranteed” yield offers.

⚠️ Regular’s advice:

Before using a protocol, always check its security audits and favor those verified by independent firms such as Certik, Quantstamp, or Trail of Bits.

The risks are comparable to those of a crypto investment, but amplified by the decentralized and fully automated nature of these systems.

The Regulatory Framework: MiCA and PSCA

Decentralized Finance still operates within a legally ambiguous environment.

While the MiCA regulation and PSCA status represent major milestones for crypto-asset regulation in Europe, DeFi — by nature decentralized and intermediary-free — remains only partially covered by this framework.

MiCA: A Foundational Framework for Crypto Regulation

Enacted in 2024, the MiCA Regulation (Markets in Crypto-Assets) aims to:

- Regulate the issuance and management of stablecoins

- Strengthen transparency requirements for issuers and investor protection

- Establish uniform rules across all EU member states

MiCA therefore applies to identified entities — such as exchanges, custodians, and token issuers — but not yet to fully decentralized protocols, which operate without a registered company, headquarters, or legal entity responsible for their governance.

PSCA: A Status for Regulated Crypto Service Providers

The PSCA (Prestataire de Services sur Crypto-Actifs, or Crypto-Asset Service Provider) status is now mandatory for any company offering crypto-related services such as:

- Custody or sale of digital assets

- Portfolio management for crypto investors

- Advisory services related to digital investments

This designation requires strict compliance with European standards on AML/CFT (Anti–Money Laundering / Counter–Terrorism Financing), technical security, and regulatory oversight.

Well-known licensed platforms include Coinhouse, Meria, and Bitpanda.

💡 Toward a Regulated DeFi?

Europe is now exploring hybrid regulatory models, where licensed providers (PSCA) could serve as bridges between traditional finance and DeFi ecosystems.

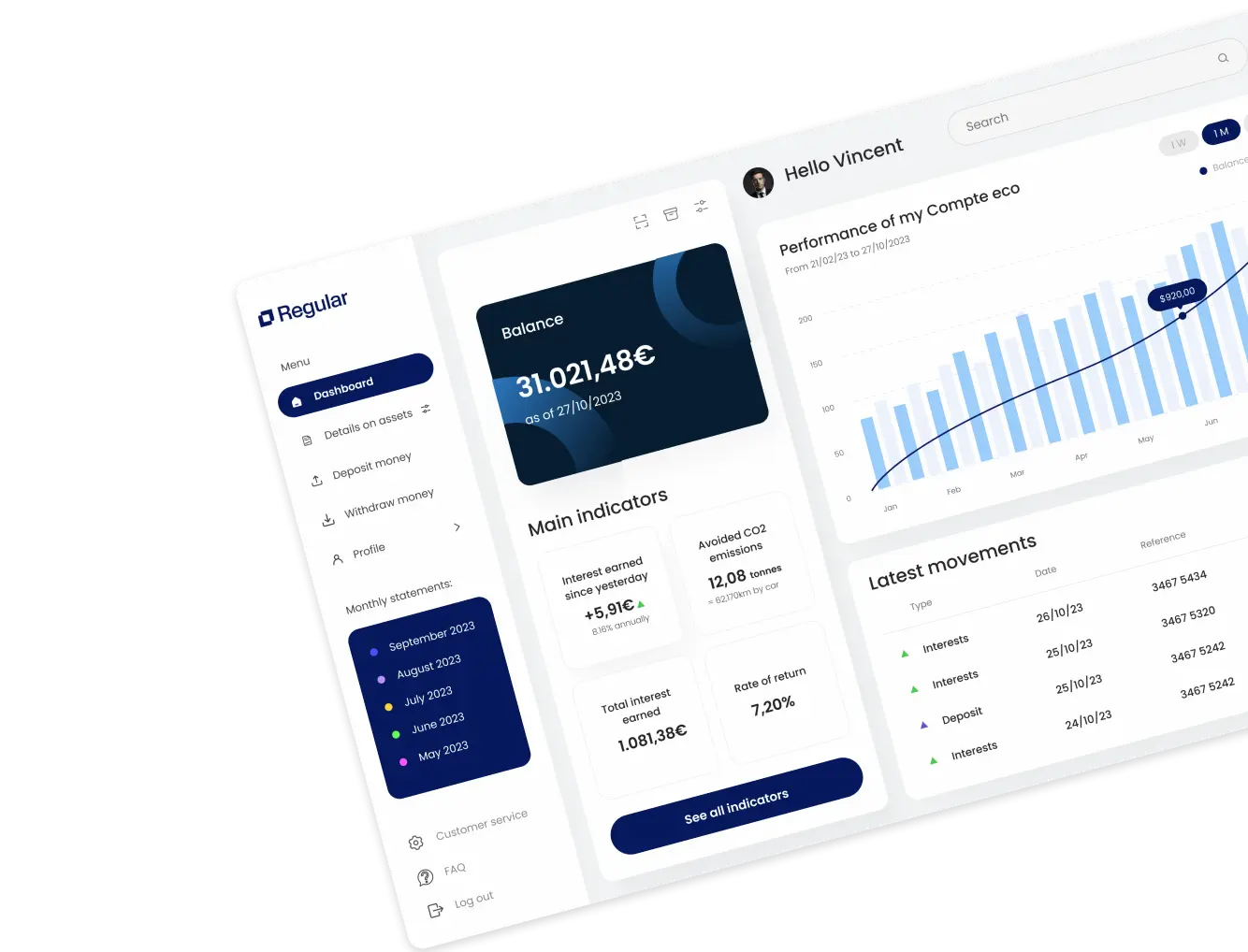

Platforms like Regular are part of this new wave — offering audited, compliant, and regulated access to DeFi protocols while fully adhering to MiCA standards and the security controls required by financial authorities.

DeFi and Corporate Treasury: A New Investment Path

For some companies, Decentralized Finance presents a new avenue for managing excess liquidity, while contributing to the transformation of global finance — a logic closely aligned with active digital investment, though with a higher degree of autonomy and technological exposure.

Unlike traditional banking products, DeFi protocols allow businesses to generate yield from stable digital assets within an automated and transparent framework.

Examples of practical applications:

- Lending stablecoins to earn steady, low-volatility returns

- Participating in audited protocols (like Aave or Compound) offering near-instant liquidity

- Investing in hybrid tokenized funds that combine blockchain efficiency with MiCA / PSCA regulatory oversight

Best Practices Before Investing

✅ Choose audited and verified protocols — favor those reviewed by reputable third parties such as Certik, Trail of Bits, or Quantstamp.

✅ Invest only non-essential liquidity — never commit funds that could affect your company’s operational cash flow.

✅ Separate your wallets — use a cold wallet for long-term storage and a hot wallet for active transactions.

✅ Maintain clear accounting records — log every crypto and stablecoin transaction for proper financial reporting.

✅ Avoid “guaranteed yield” offers — such claims often signal unverified or high-risk projects.

💬 In short:

DeFi can serve as a strategic complement to wealth management or corporate treasury operations, but it does not replace regulated financial products or capital-guaranteed investments.

Conclusion

Decentralized Finance is redefining the very foundations of global finance — automated, transparent, and borderless.

While it offers attractive returns, it also carries significant risks that require education, control, and due diligence.

The European MiCA framework and PSCA-licensed providers mark the beginning of a shift toward a regulated, safer, and more accessible DeFi ecosystem.

For financial leaders, DeFi is no longer a technical curiosity — it’s a measured opportunity for innovation, provided it is approached with prudence, oversight, and expert guidance.

💡 The future of DeFi investing lies at the crossroads of two worlds:

blockchain innovation and financial compliance.