In the digital asset ecosystem, stablecoin staking has become a natural strategy for generating passive income while limiting exposure to the high price volatility typical of Bitcoin, Ethereum, and other cryptocurrencies. However, within the European Union, the MiCA framework prohibits offering direct yield on stablecoin holdings, which restricts or excludes certain forms of direct staking.

Unlike traditional Proof-of-Stake (PoS) staking, which involves locking tokens to secure a network and validate blocks, “stablecoin staking” generally does not refer to transaction validation. Instead, it describes the different ways of allocating stablecoins to earn a return. In this case, your deposits in USDC, USDT, DAI, or other stable digital assets are used by platforms or DeFi protocols to provide liquidity or finance lending activities. In return, you receive interest.

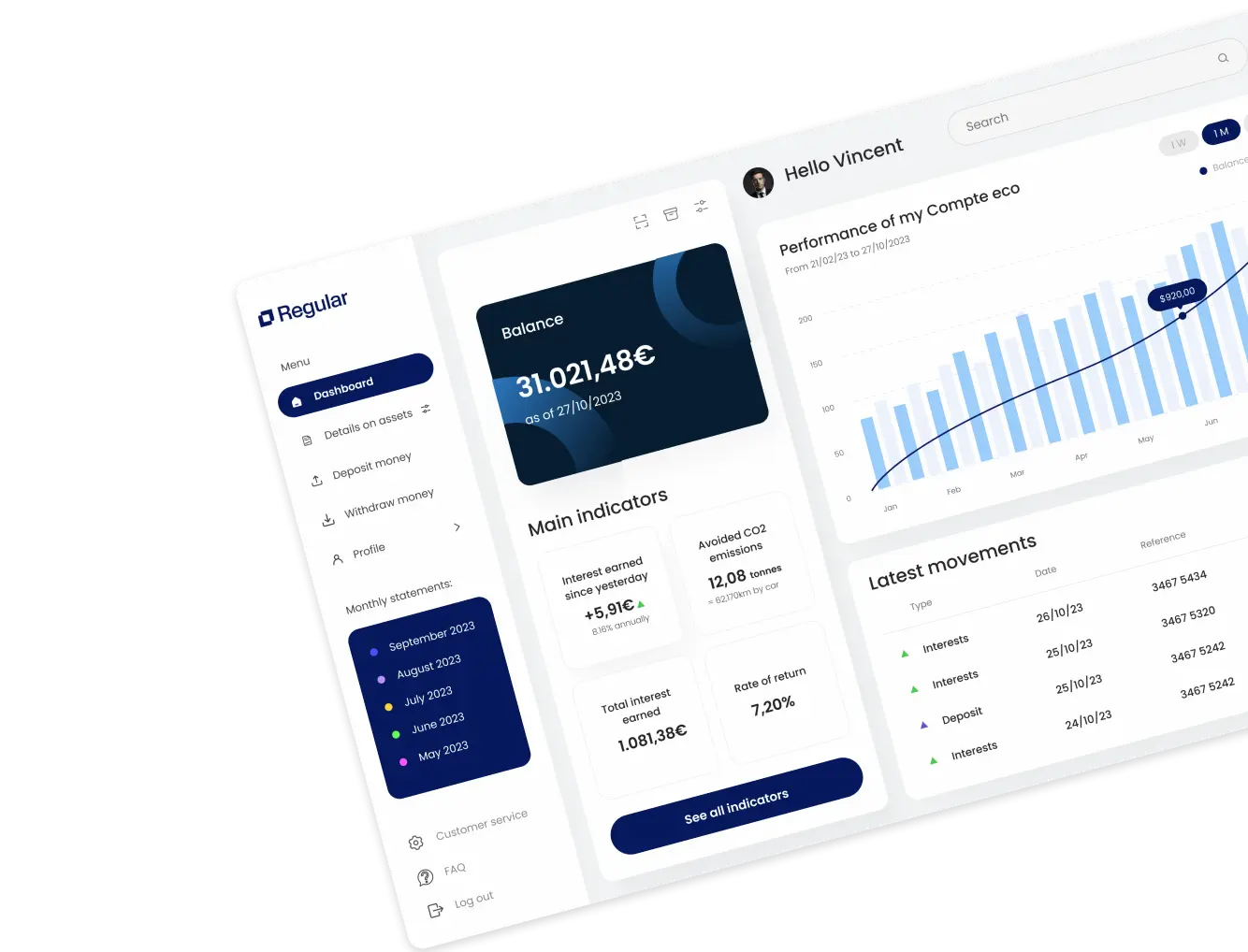

This guide by Regular explains how stablecoin staking works, the different types of platforms (centralized vs. decentralized), the realistic yield ranges, the key risks to know, and the best practices to adopt before getting started.

Summary of the article

- Principle: Stablecoin staking (USDC, USDT, DAI, EUROC…) consists of depositing tokens on CeFi or DeFi platforms that use them to lend funds or provide liquidity.

- Difference from PoS staking: you’re not validating blocks — you’re earning interest generated by market activity (loans, swap fees, incentives).

- Indicative yields:

- • CeFi: ~2% to 6% APY

- • DeFi: ~3% to 10% APY

- • Temporary incentives: sometimes >12% (not guaranteed, highly volatile).

- Key factors: borrowing demand, market depth (TVL), incentive programs, network fees, macroeconomic and regulatory context (MiCA, DORA).

- Risks: counterparty risk (bankruptcy, reserve quality), depeg events, smart contract vulnerabilities, liquidity shortages, regulatory tightening.

- Best practices: diversify platforms and stablecoins, verify audits and reputation, monitor rates and regulations regularly, and maintain a liquid reserve.

(Informational article — not investment advice.)

What is stablecoin staking?

A stablecoin is a cryptocurrency whose value is pegged to a reference asset, such as a fiat currency (e.g., USDC, USDT, EUROC) or a basket of assets and crypto collateral (e.g., DAI).

Their goal is to maintain a stable 1:1 parity with the dollar or euro, making them far less volatile than most other crypto-assets.

In the context of stablecoin staking, you are not securing a blockchain like in traditional Proof-of-Stake systems.

Instead, you deposit your stablecoins on a platform (either centralized or DeFi-based) that uses them to provide liquidity or lend funds to other market participants.

In return, you earn a yield (interest or rewards), usually expressed as APY (Annual Percentage Yield).

Native staking vs. stablecoin staking

- Native staking (PoS): your tokens are locked to help validate blocks and secure the network. Rewards are paid in native tokens (e.g., ETH staking on Ethereum).

- Stablecoin staking: your deposits are used to fund loans or liquidity pools. You do not directly contribute to network validation but earn interest generated from economic activity (lending, transaction fees, incentives).

How Stablecoin Staking Works

The process is generally the same regardless of the intermediary you choose:

1. Deposit of stablecoins

You transfer USDC, USDT, DAI, EURC, or other stablecoins to a centralized platform (CeFi) or connect your wallet to a DeFi protocol.

2. Allocation of funds

The intermediary uses your deposits for overcollateralized loans, liquidity provision (stable pools), or other DeFi strategies managed by a smart contract.

3. Interest generation

Borrowers pay interest, and/or decentralized exchanges (DEXs) redistribute swap fees. Incentives (such as governance tokens) may also be distributed depending on the period.

4. Payout to the depositor

You receive your earnings — either in stablecoins or reward tokens — on a flexible basis (withdraw anytime) or with a lock-up period, depending on the chosen solution.

- APR (Annual Percentage Rate): the simple annual rate, without automatic reinvestment.

- APY (Annual Percentage Yield): the annual rate with compound interest — earnings are reinvested continuously.

At the same nominal rate, APY will always be higher than APR if interest is compounded regularly.

Example: an APR of 6% compounded monthly gives an APY ≈ 6.17%

Stablecoin Staking Journey

Role: provide the initial capital.

DeFi: smart contracts, you keep your own keys.

Role: route deposits toward yield strategies.

Sources: borrowing interest, fees, and rewards.

Liquidity: flexible or with a lock-up period.

The Different Stablecoin Staking Options

Stablecoin staking can be done through three main models, which differ primarily in how much control you retain over your funds and the type of risks involved.

Centralized Platforms (CeFi)

Exchanges and custodial services such as Binance Earn, Nexo, or Ledger’s “Earn” feature offer a turnkey experience:

you deposit your USDC, USDT, or DAI after completing KYC verification, and the platform redistributes interest.

This simplicity comes at a cost: users are entirely dependent on the financial stability of the operator and exposed to counterparty risk in case of bankruptcy or regulatory freezes.

Typical stablecoin yields range around 2% to 6% APY.

DeFi Protocols

Protocols like Aave, Compound, Morpho, or Spark allow users to lend their stablecoins directly from their own wallets.

This approach is more transparent, with funds remaining in self-custody, but it requires a solid understanding of Web3 tools.

Rates are variable — often between 3% and 10% APY, and sometimes higher during incentive campaigns.

The main risks include smart contract vulnerabilities and rapid fluctuations in borrowing demand.

Hybrid Solutions and Yield-Bearing Stablecoins

Some services combine the simplicity of a user-friendly interface with access to decentralized protocols.

Examples include the Ledger x Kiln partnership or yield-bearing stablecoins like sDAI, which integrate a built-in yield mechanism based on real-world assets or DeFi strategies.

These innovative solutions are often subject to specific regulatory frameworks — sometimes similar to those governing financial securities — and require careful compliance verification.

European regulatory framework: MiCA restrictions on stablecoin yields

With the gradual implementation of the MiCA (Markets in Crypto-Assets) regulation between 2024 and 2025, the European Union has introduced a strict legal framework for stablecoins.

MiCA distinguishes between two main categories:

- EMTs (Electronic Money Tokens) — stablecoins backed by a single fiat currency (such as the euro or dollar), considered as electronic money.

- ARTs (Asset-Referenced Tokens) — stablecoins backed by a basket of assets (currencies, commodities, or crypto-assets) aiming to maintain price stability through collateral diversification.

One of the most impactful provisions of MiCA is the ban on paying direct yield or interest to holders of regulated stablecoins (EMTs or ARTs).

In other words, the issuer of a regulated stablecoin cannot reward simple holding of the token.

Any yield must come from external mechanisms such as DeFi lending, liquidity pools, or over-collateralized loans — not from the issuer itself.

This restriction aims to prevent stablecoins from functioning as unregulated savings or investment products, which would otherwise require a banking license.

In practice:

- European CeFi platforms will have to review or remove “Earn” programs offering interest on regulated stablecoins (like USDC or EUROC).

- DeFi protocols are not directly targeted by MiCA, but the yields they offer must stem from real economic activity (borrowing, fees, liquidity provision), not from automatic holding rewards.

For users, this means that stablecoin staking within the European Union now relies entirely on external yield sources — transparent, auditable, and detached from the stablecoin issuer.

The idea of “earning interest by simply holding a stablecoin” is now prohibited under MiCA for all regulated tokens.

Summary Table – Stablecoin Staking Options

| Option | Indicative Yield Range (APY) | Risk Level* | Key Points to Monitor |

|---|---|---|---|

| Centralized Platforms (CeFi) | 2% – 6% | Moderate to high (depending on operator strength) | Counterparty risk (bankruptcy, regulatory freeze), full dependence on the platform |

| DeFi Protocols | 3% – 10% (can exceed 12% during temporary incentives) | Variable (mainly technical) | Smart contract vulnerabilities, rapid rate fluctuations, need for active wallet management |

| Hybrid Solutions / Yield-Bearing Stablecoins | 4% – 9% | Variable depending on issuer and legal framework | Possible classification as a security, counterparty reliability, transparency of reserves |

*Risk levels are indicative only — they may vary significantly depending on the chosen platform, market conditions, and the quality of audits.

How Much Can You Expect to Earn?

Stablecoin staking returns vary widely depending on the type of solution and the market environment:

- Centralized Platforms (CeFi): typically 2% to 6% APY, depending on the operator’s financial strength and borrowing demand.

- DeFi Protocols: usually 3% to 10% APY, with higher peaks during periods of strong liquidity demand or temporary incentive campaigns.

- Temporary Incentives: certain liquidity mining or protocol launch campaigns can exceed 12% APY, but such yields are extremely volatile and short-lived.

These figures are only rough estimates — they fluctuate constantly based on borrowing demand, total value locked (TVL), network fees, and incentive programs offered by each protocol.

Reminder

Yield rates are never guaranteed.

They can rise or fall rapidly depending on market conditions, liquidity dynamics, and protocol or platform decisions.

Factors Influencing Yields

Borrowing Demand & Market Depth (TVL)

When borrowing demand increases or TVL (Total Value Locked) is low, rates tend to rise.

Conversely, high liquidity and low demand push yields downward.

Temporary Incentives (Liquidity Mining)

Reward tokens or protocol launch campaigns can temporarily boost yields.

Once the campaign ends, rates usually return to normal levels.

Network Fees (Gas)

High transaction fees — especially during network congestion — reduce net yield, particularly for smaller deposits or strategies requiring frequent transactions.

Macroeconomic & Regulatory Context (MiCA, DORA, etc.)

Rising traditional interest rates make crypto yields less attractive.

Meanwhile, new regulations can restrict access to certain services or reshape supply and demand, directly affecting offered rates.

Summary Flow – Factors Affecting Stablecoin Yield

Abundant liquidity + low demand → lower yields.

Effect is short-lived — once campaigns end, yields drop.

Impact is stronger for small deposits or frequent-transaction strategies.

New rules or compliance requirements can restrict access or change service offerings, influencing available rates.

Risks to Be Aware Of

Even though stablecoins are designed to maintain a stable value, the staking mechanisms that generate yield expose investors to several types of risk.

Understanding them is essential to properly calibrate your allocation and choose reliable platforms.

Counterparty and Reserve Risk

A stablecoin’s stability depends on the quality and transparency of its issuer’s reserves (banks, Treasury bills, crypto collateral).

Poor reserve management, lack of audits, or the bankruptcy of a centralized actor can lead to withdrawal freezes or loss of confidence.

Stablecoin Depeg Risk

A massive sell-off, crisis of confidence, or issue with reserves can cause the token’s price to deviate from its intended peg (e.g., $1 or €1).

Arbitrage mechanisms are designed to restore parity, but they may take time or fail during market stress.

Technical Risk (Smart Contracts / Bugs)

In DeFi, yields depend on smart contracts.

A code vulnerability, software bug, or hack can disrupt withdrawals or cause partial — or total — loss of funds.

Liquidity Risk (Mass Withdrawals / Low TVL)

A protocol with low Total Value Locked (TVL) or facing a bank run may make withdrawals difficult or expensive.

Large spreads and unusually long delays are red flags to watch for.

Regulatory Risk (Legislative Changes)

The legal environment is evolving quickly (e.g., MiCA, DORA in Europe, new rules in the U.S.).

A platform or protocol may be forced to restrict access or modify its conditions of use in response to new regulations.

Summary Table – Main Stablecoin Staking Risks

| Risk | How It Occurs | Warning Signs | Best Practices |

|---|---|---|---|

| Counterparty / Reserves | Insufficient or poorly managed reserves, issuer bankruptcy | Infrequent audits, solvency rumors | Review official attestations, choose audited and reputable issuers |

| Stablecoin Depeg | Crisis of confidence or supply/demand imbalance | Persistent deviation from reference price | Check prices regularly across multiple platforms |

| Technical (Smart Contracts) | Code vulnerabilities, bugs, or hacks | Security alerts, reported incidents on the protocol | Choose audited protocols, follow developer announcements |

| Liquidity | Massive withdrawals, shallow market depth (low TVL) | High spreads, unusually long withdrawal times | Diversify platforms, monitor TVL and trading volume |

| Regulatory | Legal changes or tightening regulation | Official announcements, token delistings | Stay informed about regulatory updates and official communications |

Best Practices Before Getting Started

Before staking stablecoins, it’s crucial to follow a few simple but effective guidelines:

- Diversify your allocations: Spread your funds across multiple platforms and stablecoins to limit exposure to a single point of failure.

- Assess platform reliability: Prioritize audited protocols or intermediaries with a transparent track record and clear governance.

- Monitor rates and conditions regularly: Published yields (APY / APR) can change quickly depending on borrowing demand, liquidity, or temporary incentives.

- Stay up to date on regulations: Frameworks such as MiCA or DORA can alter access, reporting, or compliance requirements.

- Keep a liquid reserve: Always maintain a portion of your capital in easily accessible stablecoins or fiat currency to respond quickly to emergencies or market stress.

Conclusion

Stablecoin staking allows investors to earn passive income while maintaining much lower volatility than traditional cryptocurrencies.

Whether through CeFi platforms or DeFi protocols, yield opportunities (typically 2% to 10% APY) are increasingly attractive.

However, this strategy is not risk-free: counterparty exposure, depeg events, smart contract vulnerabilities, liquidity issues, and regulatory changes must all be considered.

Before getting started, verify protocol reliability, review security audits, and stay alert to legal developments.

Disclaimer

This article is provided for informational purposes only and does not constitute investment advice.

Any investment decision should be made based on your own research and, if necessary, with the assistance of a qualified professional.

FAQ – Stablecoin Staking

Which stablecoins can be staked?

The most common ones are USDC, USDT, and DAI, sometimes EUROC/EURC depending on the platform. “Staking” here refers to depositing on lending or liquidity services (DeFi/CeFi), or using yield-bearing versions (e.g. sDAI). Always check chain compatibility (Ethereum, L2, BSC, etc.) and available liquidity.

What average yield can you expect?

Indicatively: 2%–6% APY in CeFi, 3%–10% APY in DeFi. Temporary incentives can push yields above 12%, but these increases are volatile and not guaranteed. Rates vary depending on borrowing demand, TVL, and reward programs.

Can you withdraw your stablecoins at any time?

Usually yes for “flexible” offers. Some solutions impose delays (unlocking periods, queues, withdrawal windows) or fees. Always read the product terms (lock-up, penalties, interest distribution schedule) before depositing.

What are the differences between CeFi and DeFi staking?

In CeFi, the operator manages custody and redistributes interest — simple experience but with counterparty risk and potential regulatory constraints. In DeFi, you interact on-chain through smart contracts — self-custody, transparency, but technical risk (bugs, hacks) and variable rates.

What are the main risks?

Counterparty/reserve risk (CeFi), stablecoin depeg, smart contract vulnerabilities (DeFi), liquidity issues (low TVL, massive withdrawals), and regulatory changes (access restrictions, delistings). Mitigate them through diversification, audited protocols, and regular monitoring of announcements.

What taxation applies in France?

The tax regime depends on the taxable event and your individual situation. In practice, converting crypto → fiat currency can trigger capital gains taxation, while crypto → crypto exchanges are treated differently. As this framework evolves, consult a professional (lawyer, accountant).