Endorsed by the ecosystem

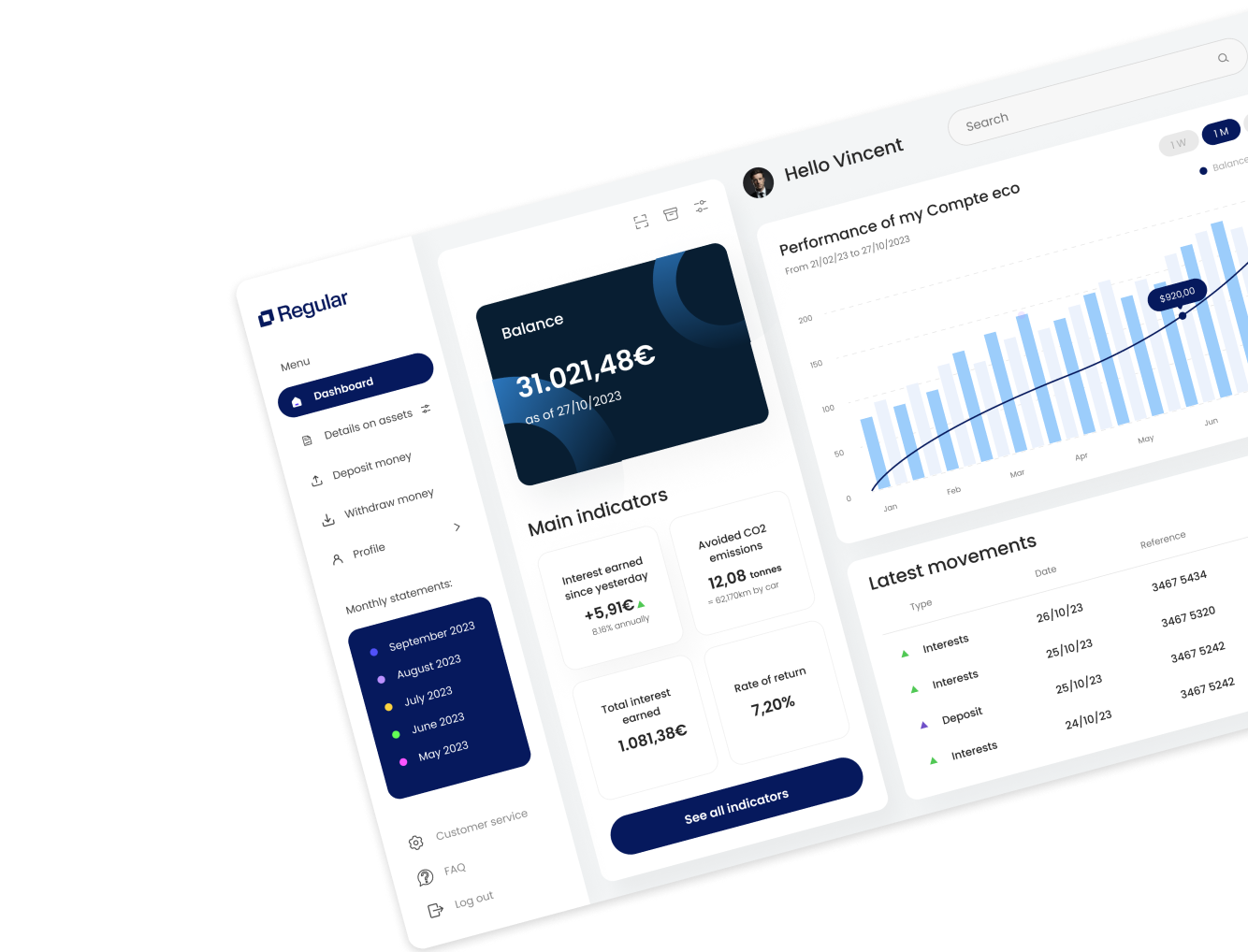

Earn every day. Easily.

Boost your savings, whether you are an individual or a business

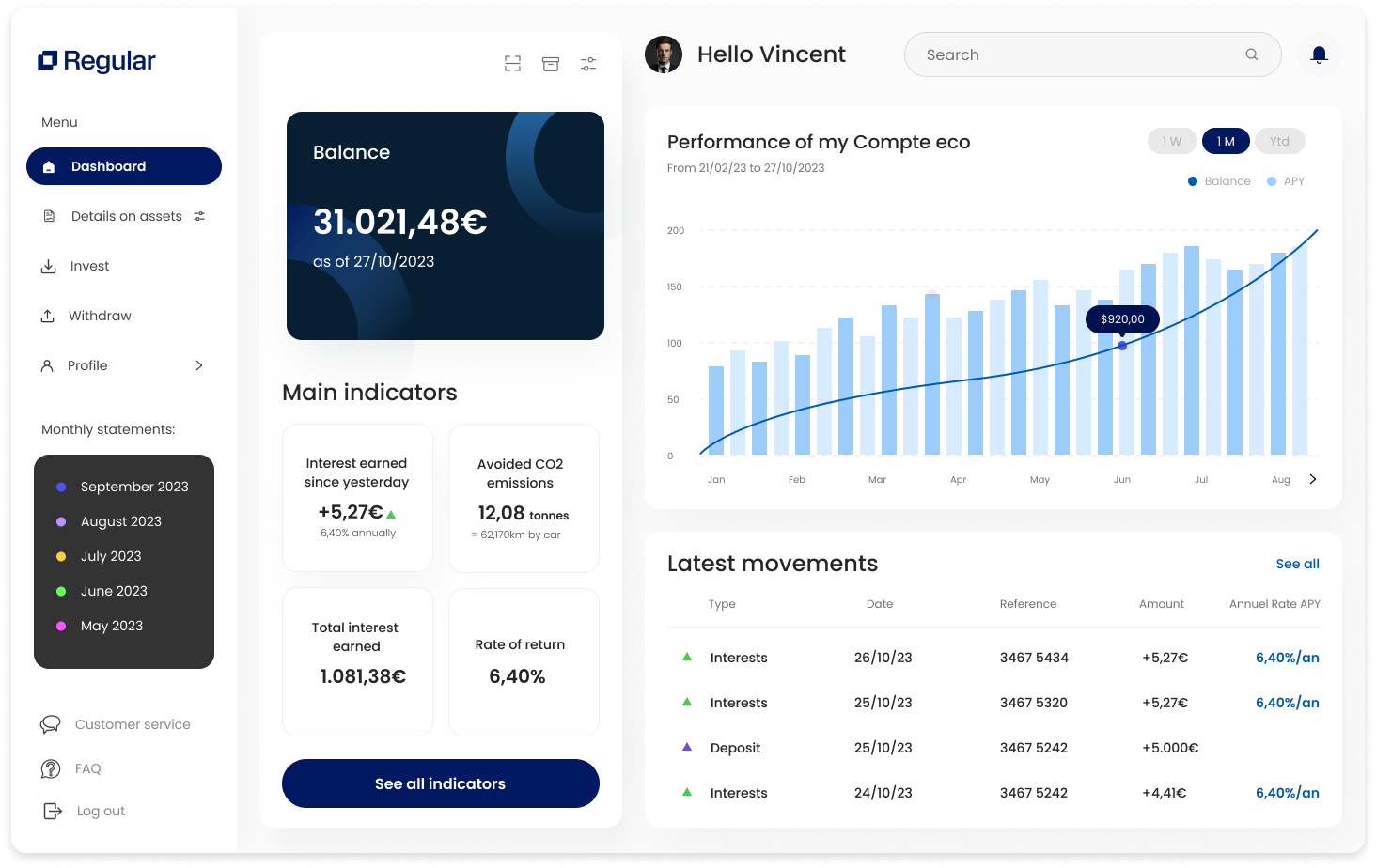

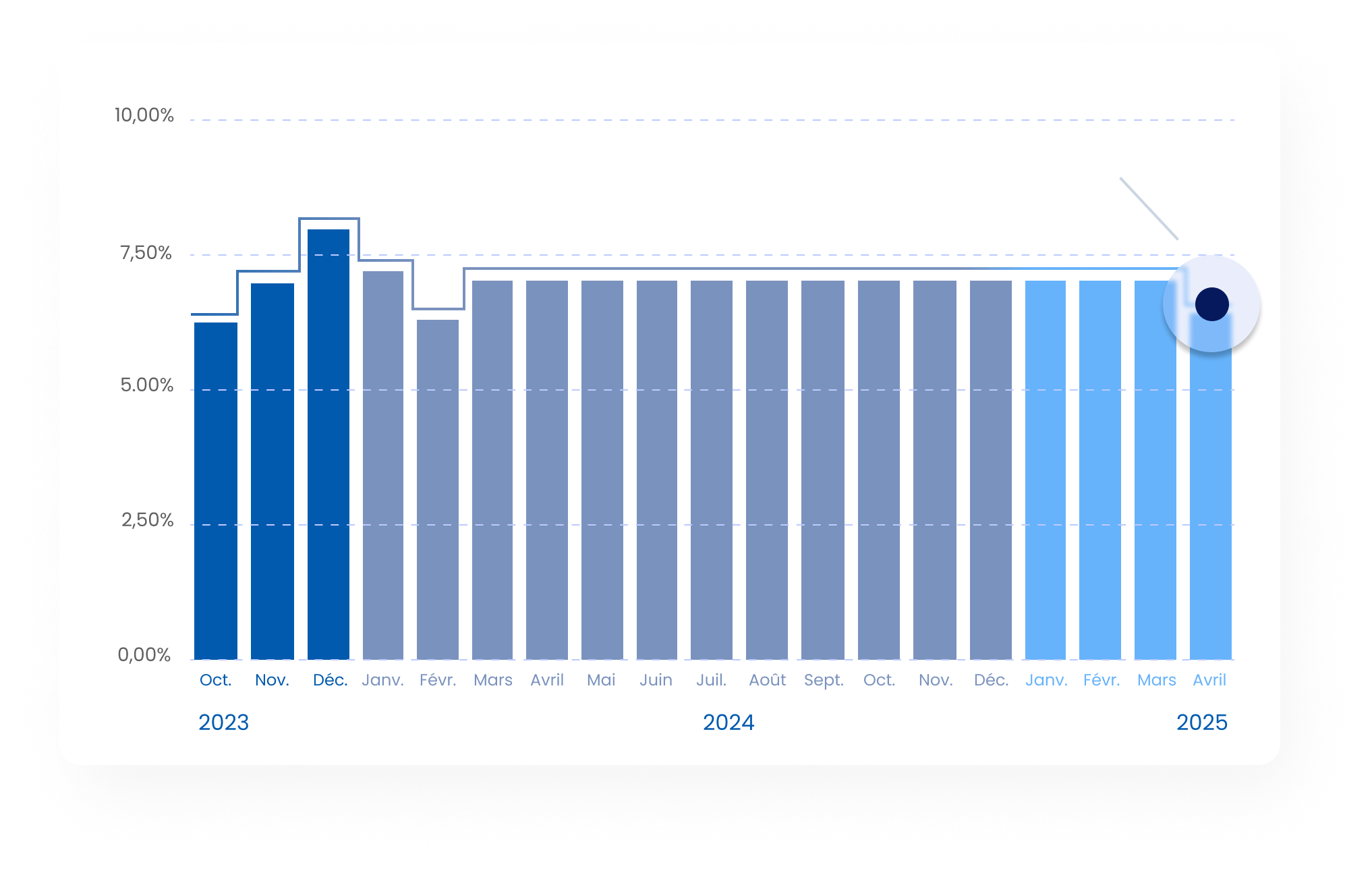

Historical yield.

Current annual yield 6.40%

The interests you receive every day are at 6.2041%/year.

The interest received is capitalized and itself earns interest on subsequent days. The yield over one year is therefore 6.40% (APY rate).

Net of service charge

The total yield generated by the assets is over 6.40%/year.

You get 6.40%, and the surplus is retained for management fees and the purchase of carbon credits.

TOTAL YIELD

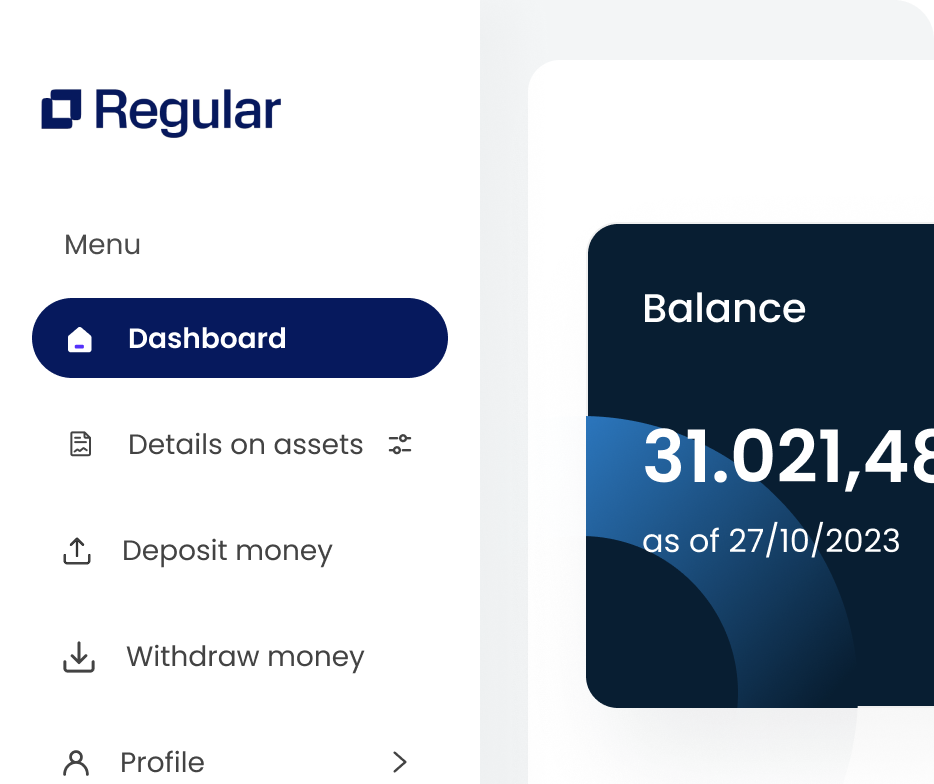

Easy investing. Easy fiscal rules.

A simple transfer in euros to invest.

Easy account opening.

Directly on our website

Sign up in just a few clicks and start using your account instantly—no downloads needed.

Open a free account

A regulated business

To operate the Regular account, our company is registered with the Autorité des Marchés Financiers (French financial markets authority) as a Prestataire de Services sur Actifs Numériques (PSAN).

Security first.

Robust, proven choices to protect your assets without compromise.

The strong growth of stablecoins.

A positive impact for climate

€2,000 on the account = 1 ton of CO2 sequestered per year

And by 2027, our objective is for more than 80% of our funds to be invested in tokenized green assets, such as solar power plants, wind turbines or green bonds.

Klimadao

A portion of our returns is allocated to purchasing certified carbon credits with CO₂ reductions. KlimaDAO, a decentralized organization, utilizes blockchain to enhance transparency and efficiency in carbon credit trading.

By tokenizing carbon credits, KlimaDAO aims to streamline climate finance and address global climate challenges.

Tailor-made solutions for wealth managers

More and more HNWI customers are looking to diversify part of their wealth into this product, away from the risk of traditional banks.

You are a wealth manager or family office?

We offer tailor-made solutions to make it easier for your customers to invest.

Contact us to find out moreCustomer Reviews

Frequently Asked Questions

You can also discover all our articles on our help and support center.

Which stablecoins do you use?

What is the yield?

We are confident that the rate of return will remain high in the coming years as we believe stablecoin trading volumes will grow. Indeed, stablecoins, particularly those linked to the US dollar and the euro, meet a growing need in many countries, not just in Europe or the United States: Turkey, Vietnam, India, Argentina, the Philippines, Mexico, etc.

Are the funds and returns guaranteed?

How is the yield generated?

What are the revenues of Regular Finance, the company that operates the Regular Account?

The yield depends on the trading volumes that are executed on the liquidity pools and in the yield protocols. The rate of return fluctuates every day. The part of the return which exceeds the fixed interest paid to the client is the gross margin of Regular Finance, which therefore accepts to see its margin fluctuate in order to ensure a greater simplicity to the client.

What is the legal mechanism?

The principle of the Regular Account is as follows: - when you make a deposit, you purchase shares of assets already invested and managed by Regular - when you make a withdrawal, you resell the asset shares that you held. Your deposit is 100% dedicated to purchasing assets. These assets are liquid, which is why you can withdraw 100% of your funds at any time. We invest in tokens which are staked in liquidity pools and yield protocols, such as Yearn Finance, Convex or Velodrome Finance. Your investment is therefore exposed to the operation of these liquidity pools and yield protocols. To hold and manage tokens, our technical infrastructure relies on our partner Fireblocks, a global leader in providing secure solutions for holding digital assets. Please note that Regular is an investment scheme which enables you to invest part of your savings. Even if the risk is low, your capital is not guaranteed.

Past performance is not a reliable indicator of future performance.

To understand how the Regular account works, you can read the articles in our support section “Informations générales”.

Learn moreWhat if you tested ?

Open a Regular account for free and start, for example, with an initial investment of €1,000 or €2,000 to test our product. You can withdraw your funds at any time, and there's no commitment period.

Open a free account- Investissez avec impact

- Flexible dès le premier jour