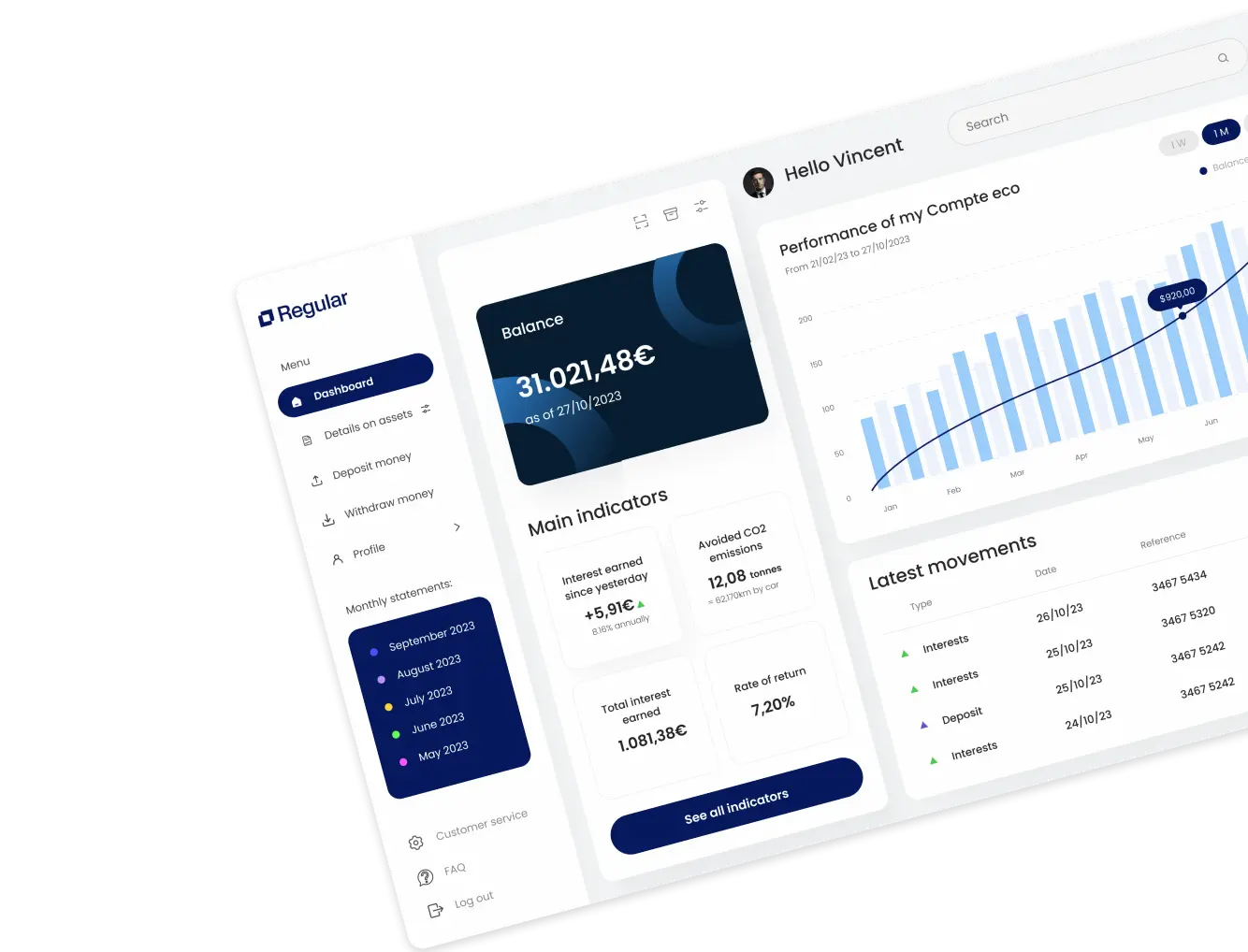

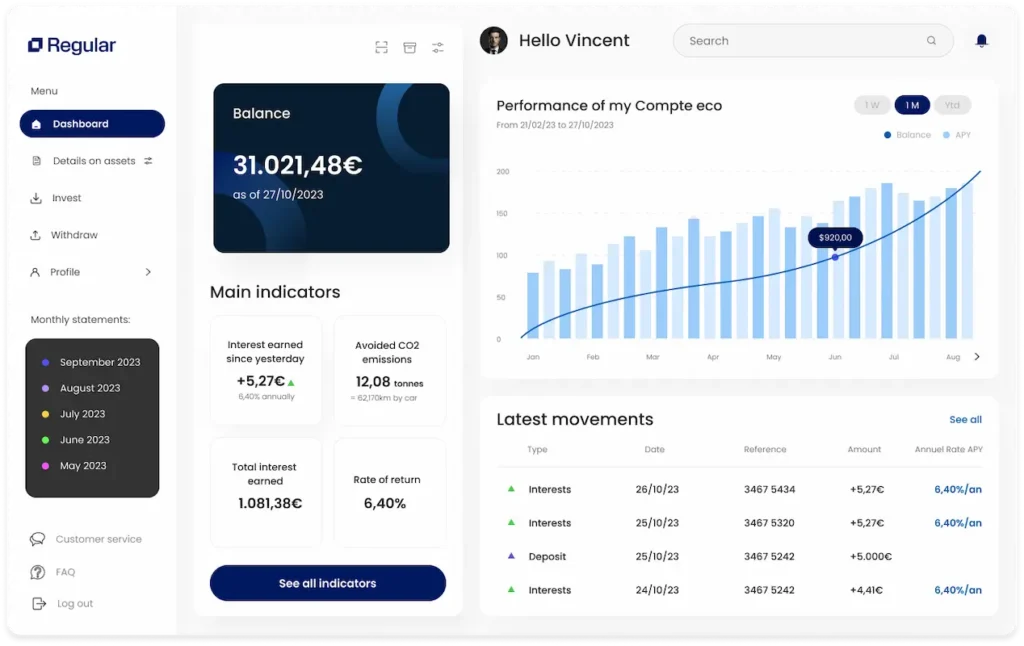

Enjoy a yield of 6.40%

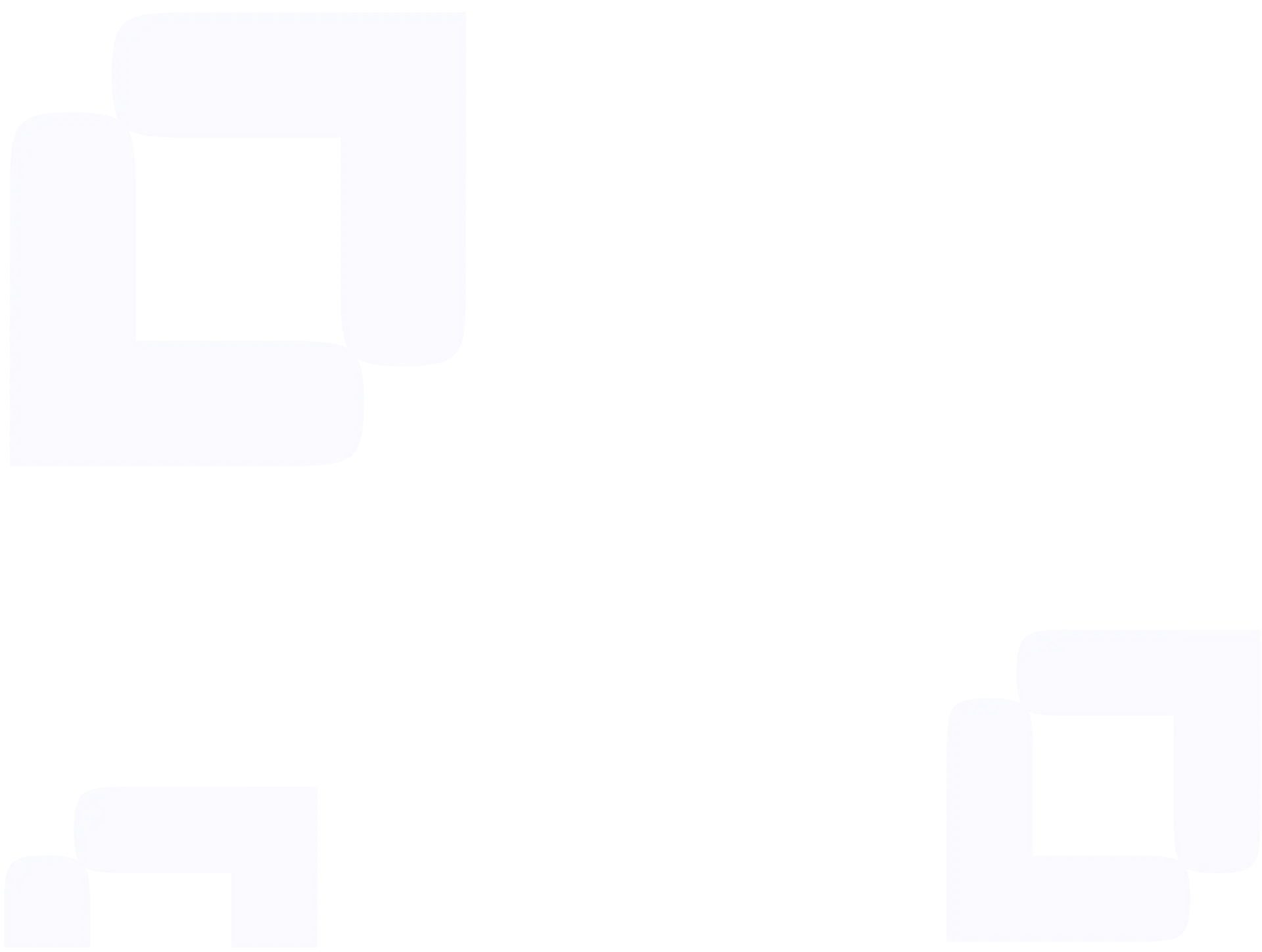

Interest paid every day, free withdrawals, 100% of your funds invested in yield-bearing digital assets: discover the Regular account (registered PSAN/AMF under number E2023-72)

PSAN #E2023-72

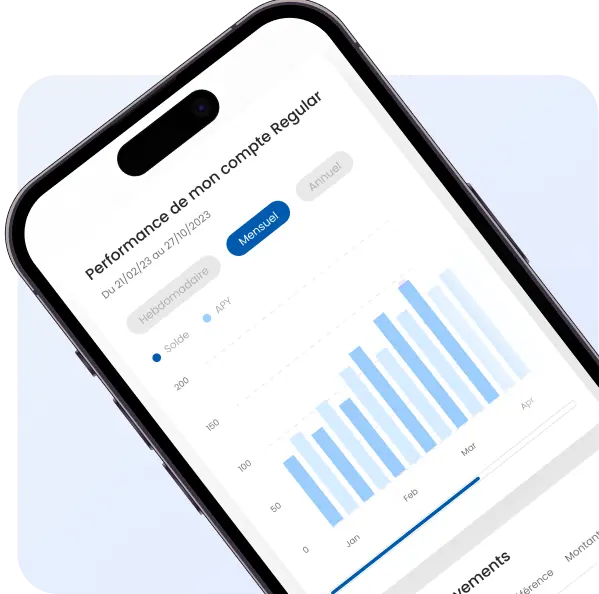

Earn every day. Easily.

Boost your savings, whether you are an individual or a business

Deposits and withdrawals

at any time and free of charge

No subscription

You directly receive the return net of fees

100% of your funds

are invested in digital assets

Rate of return – 6.40%/year

No maximum limit

Interest paid everyday

Simplicity – no technical knowledge required

A simple transfer in euros to make a deposit

Asset diversification

A new asset class with decentralized finance.

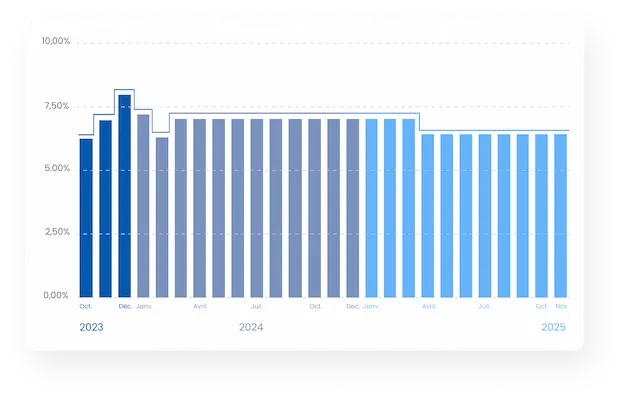

Historical yield.

Since April 2025

annual rate

6.40%Current annual yield 6.40%

The interests you receive every day are at 6.2041%/year. The interest received is capitalized and itself earns interest on subsequent days. The yield over one year is therefore 6.40% (APY rate).

Auto Compound

Interest received is itself interest-bearing.

Regularity

Return paid once a day, every day.

Net of service charge

The total return generated by the assets is greater than 6.40% per year. The return paid to the client is 6.40%, and the surplus is retained for management fees and operational security.

Management fees

Platform analysis, execution, daily supervision + EUR/USD currency hedging.

Security

Continuous monitoring of assets, strategies and positions.

TOTAL YIELD

TOTAL YIELD

Surplus retained for service fees.

6.40%

/year per client

Easy investing. Easy fiscal rules.

A simple transfer in euros to invest.

Companies

Interest is accounted for in the usual way as financial income.

Individuals

No tax payable as long as you have not withdrawn any interest (confirmed by a rescript from the tax authorities).

If you withdraw interest :

- Your tax is deducted at source

- Your tax return is pre-filled.

Easy account opening.

Directly on our website

Sign up in just a few clicks and start using your account instantly—no downloads needed.

Open an account

A regulated business

To operate the Regular account, our company is registered with the Autorité des Marchés Financiers (French financial markets authority) as a Prestataire de Services sur Actifs Numériques (PSAN).

Security first.

Robust, proven choices to protect your assets without compromise.

Secure Custody with a Global leader

To secure your assets, we use the services of the global leader, which also provides services to BNP Paribas, ABN AMRO, and Revolut.

Withdraw Securely to Your Own Account

In the event of a withdrawal, the funds can only be transferred to a bank account in your name.

Audited by Cybersecurity Experts

Our systems have been audited by Vaadata, a cybersecurity specialist.

Your Assets, Fully Segregated

Your assets are kept separate from our company’s balance sheet.

The strong growth of stablecoins.

$8,500 billion traded in Q2 2024.

Tether, the USDT issuer, holds more than $100bn in US Treasuries, more than the German state.

Stablecoins are specific crypto assets whose value is pegged to a currency such as the USD or Euro. Their stability makes them suitable for daily transactions or as a reserve, while retaining the advantages of a digital currency: transparency, low costs, speed, liquidity.

Major players operate their own stablecoin, including Paypal with PYUSD, Blackrock (BUIDL) and Société Générale Forge (EURCV).

Stablecoins are superconductors for financial services. Thanks to stablecoins, businesses around the world will benefit from significant improvements in speed, coverage, and costs in the years to come.

Patrick Collison

CEO Stripe | 22/10/24

Tailor-made solutions for wealth managers

More and more HNWI customers are looking to diversify part of their wealth into this product, away from the risk of traditional banks.

You are a wealth manager or family office?

We offer tailor-made solutions to make it easier for your customers to invest.

Contact us to find out moreFrequently Asked Questions

You can also discover all our articles on our help and support center.

We have chosen to work only with stablecoins whose value is guaranteed to be at least 100% backed by other assets when they are created. For example, when an EURC is issued, a traditional euro is placed in a bank as collateral. This principle provides security to solidify the existence of the stablecoin, unlike other stablecoins that have experienced setbacks in the past because they were simply algorithms with no collateral deposited (e.g. UST).

We continuously receive returns from the liquidity pools in which we have placed stablecoins. For the customer, the return is paid once a day at a rate of 6.40% per annum.

The balance of the return generated by the assets is used to purchase carbon credits and to cover Regular's gross margin for service fees.

We are confident that the rate of return will remain high in the coming years as we believe that stablecoin trading volumes will grow. Stablecoins, particularly those linked to the US dollar and the euro, are meeting a growing need in many countries, not only in Europe and the United States, but also in Turkey, Vietnam, India, Argentina, the Philippines, Mexico, and elsewhere.

By making an investment, you acquire shares in liquidity pools and yield protocols, to which you are exposed. To better understand how the Regular account works, we invite you to consult the articles in our Help Center, under 'General Information'.

Then we bring these digital currencies to exchanges, which allow conversions between euro stablecoins and dollar stablecoins. A portion of the exchange fees is paid to us.

These exchanges are automated and virtual, and called Liquidity Pools. We also deposit stablecoins into yield protocols, which manage investments in these liquidity pools. In both cases, funds can be withdrawn at any time.

For example, when we place stablecoins on the Convex DOLA-FRAX pool, it remunerates liquidity providers for an average return of 12%/year currently.

And by 2027, our goal is to reach 50% of assets linked to tokenized Real World Assets (such as green bonds, solar power plants or wind turbines).

– 6.40% is paid to the customer

– the balance is retained by Regular Finance, i.e. 2.33% in this example.

The return depends on the trading volumes executed on liquidity pools and in yield protocols. The rate of return fluctuates daily. The portion of the return that exceeds the fixed interest paid to the client is Regular Finance's gross margin, which therefore accepts that its margin will fluctuate, for the sake of simplicity for the client.

– when you make an investment, you buy shares in assets already invested in and managed by Regular,

– when you make a withdrawal, you sell the shares you held. Your investment is 100% dedicated to the purchase of assets.

These assets are liquid, which is why you can withdraw all of your funds at any time. The assets are tokens that are proof of deposit of liquidity, staked in liquidity pools and yield protocols, such as Convex or Aerodrome Finance. Your investment is therefore exposed to the functioning of these liquidity pools and yield protocols.

To store the tokens, our technical infrastructure relies on our partner Fireblocks, a global leader in providing secure solutions for storing digital assets. Please note that the Regular account is an investment account regulated in France.

Past performance is not a reliable indicator of future results.

Investments in this product are subject to a risk of capital loss. Take the time to learn and diversify your assets. To understand how the Regular account works, you can also consult the articles in our support section under “General Information”.

Find out more