Intérêts composés

Les intérêts reçus produisent eux-mêmes des intérêts

Reconnu par l’écosystème

Pour entreprises et particuliers.

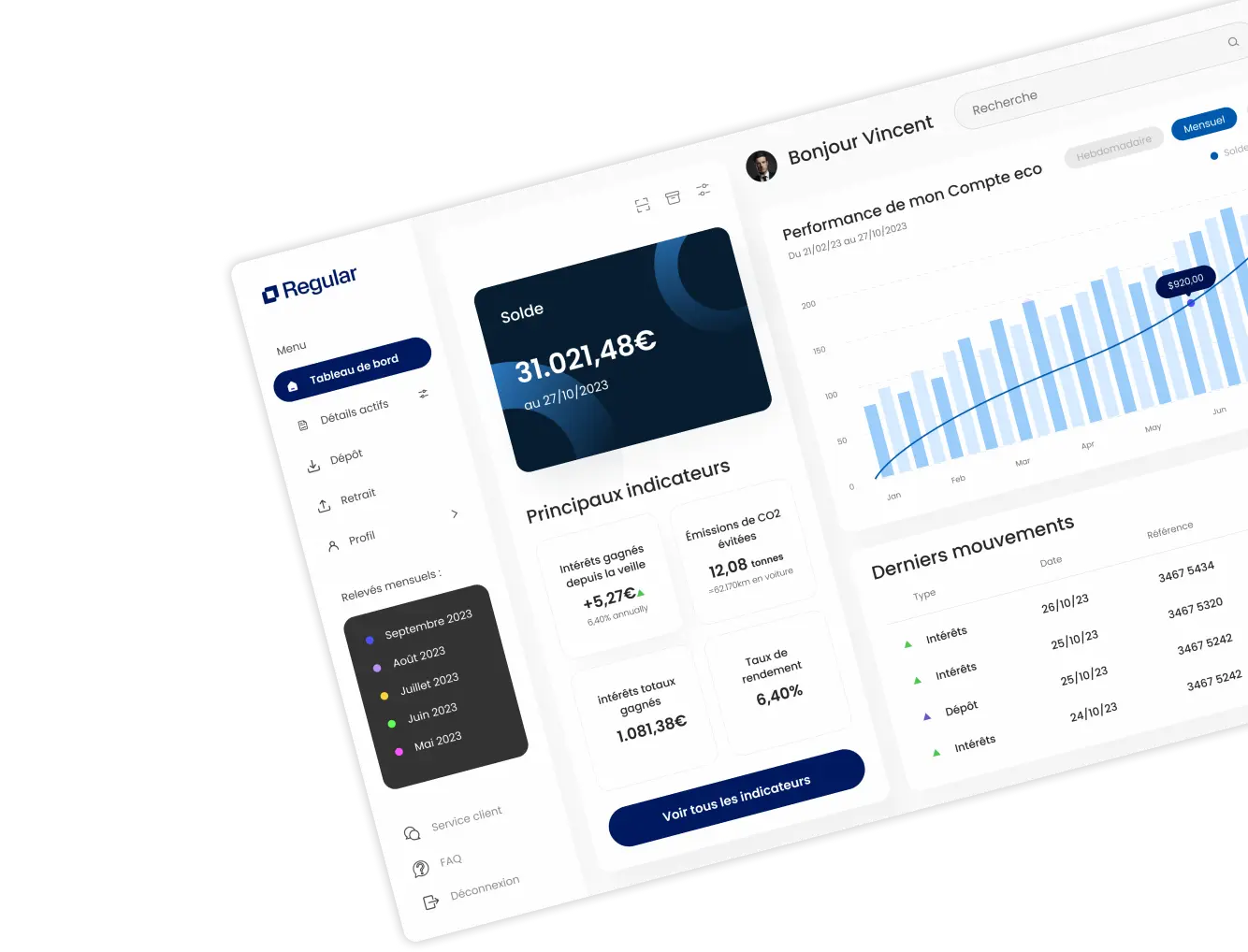

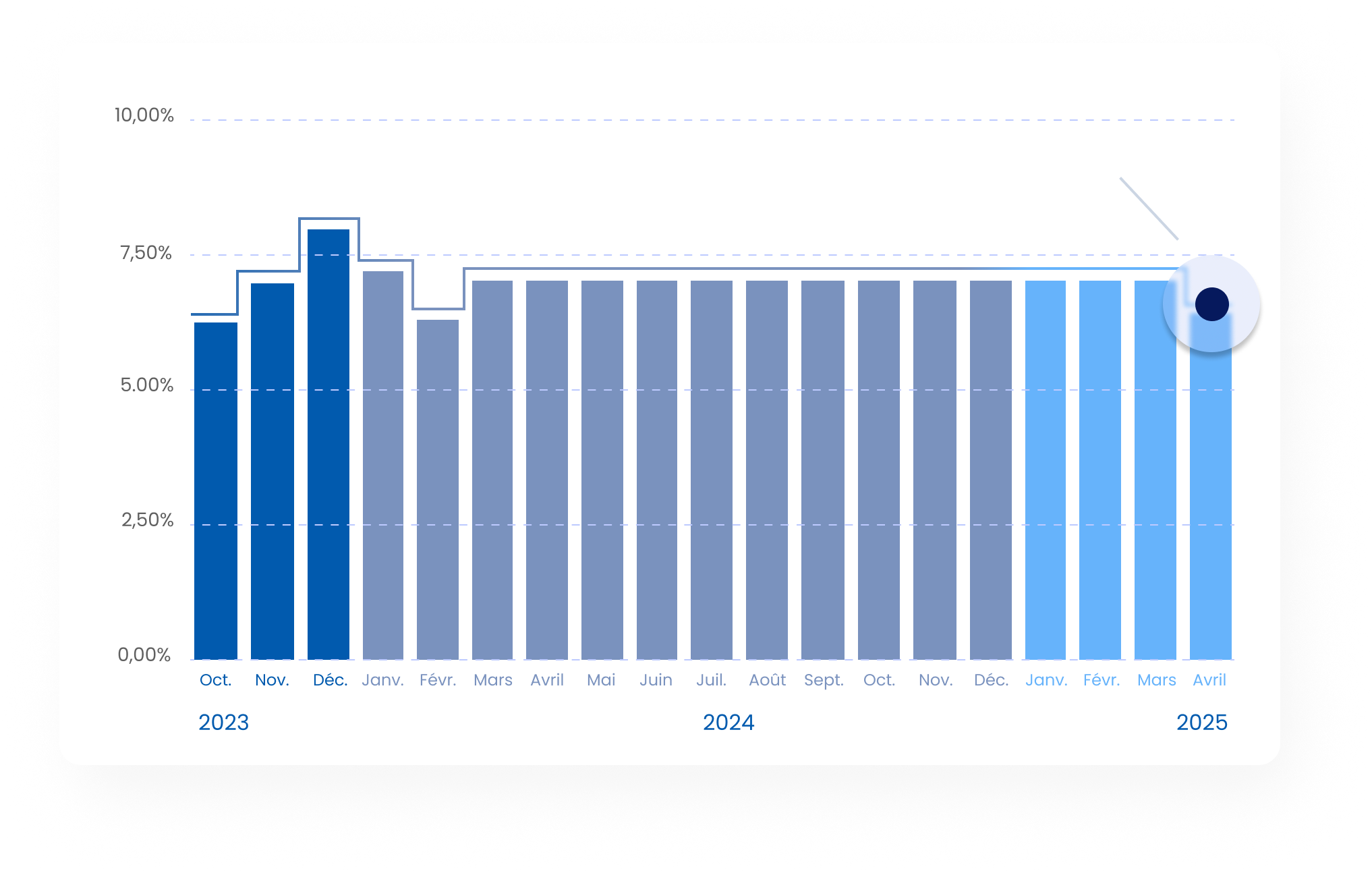

Le taux de rendement versé chaque jour est d'environ 6,2041% annuel.

Les intérêts reçus sont capitalisés et produisent eux-mêmes des intérêts les jours suivants. Le rendement sur un an (taux APY) est donc de 6,40%.

Le rendement total généré par les actifs est supérieur à 6,40%/an. Le rendement versé au client est de 6,40%, et l'excédent est conservé pour frais de gestion et achat de crédits carbone.

RENDEMENT

RENDEMENT

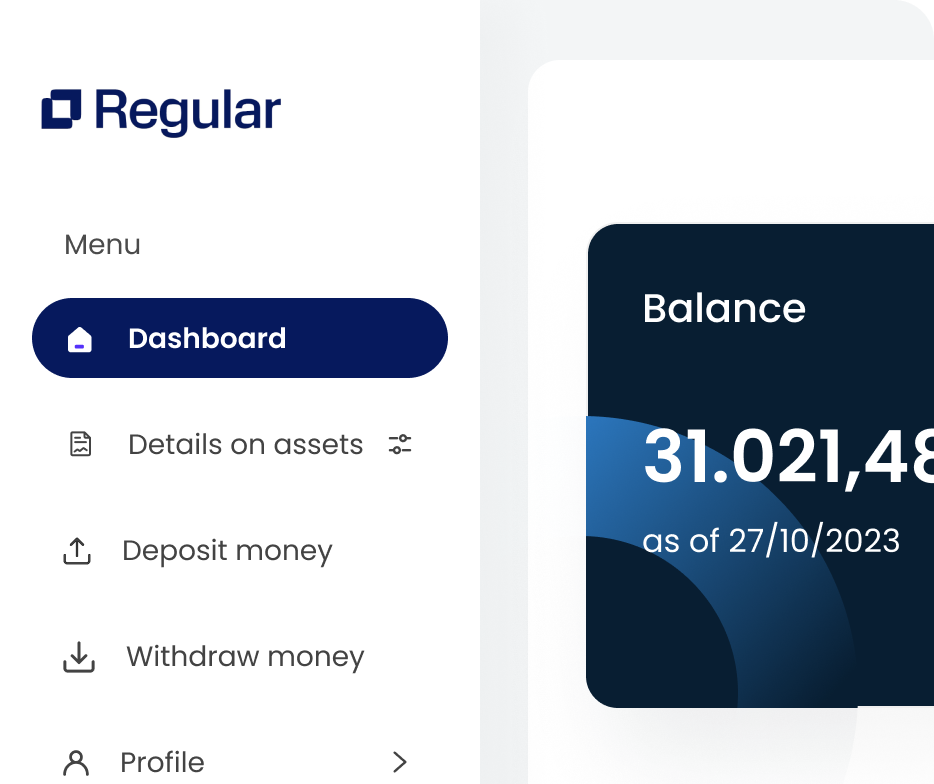

Un simple virement en euros pour effectuer un placement.

Inscrivez-vous en quelques clics et commencez à utiliser votre compte immédiatement — aucun téléchargement requis.

Ouvrir un compte

Pour opérer le compte Regular, notre société est enregistrée comme Prestataire de Services sur Actifs Numériques (PSAN) auprès de l'Autorité des Marchés Financiers.

Des choix robustes et éprouvés pour protéger vos actifs sans compromis.

De plus en plus de clients HNWI souhaitent diversifier une partie de leur patrimoine sur ce produit pour se dérisquer des banques traditionnelles.

Nous vous proposons des solutions sur mesure pour faciliter l’investissement par vos clients.

Contactez-nous pour en savoir plus

Vous pouvez également découvrir tous nos articles sur notre centre d'aide et support.

Pour comprendre comment fonctionne le compte Regular, vous pouvez aussi consulter les articles de notre support dans la rubrique 'Informations générales'.

En savoir plusOuvrez gratuitement un compte Regular et démarrez par exemple avec un premier placement de 2000€ pour tester notre produit. Vous pouvez retirer vos fonds à tout moment, il n’y a pas de durée d’engagement.

Ouvrir un compte